June 26, 2019

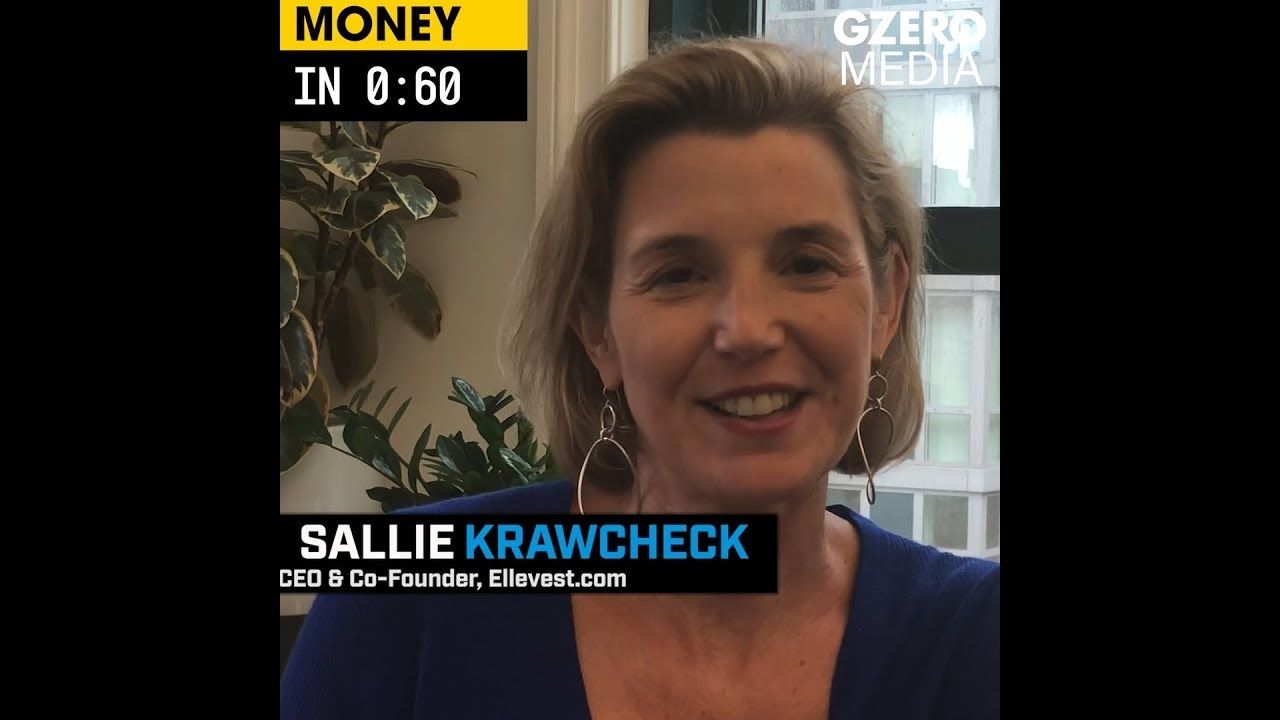

I have several loans outstanding. In what order do I pay them off?

OK, so there are a couple of different ways to approach them — both, it's sort of a weird snow analogy. So, make a list of the loans you have outstanding, the balances and the interest rates. Now, the snowball method is you start with the smallest loan you've got, right Deedi? OK, the smallest loan you've got. You pay that off first, then you pay the next in size, the next in size, the next in size. So the snowball sort of builds, if that analogy works for you. The other is the avalanche method, where you start off with the highest interest rate, you pay that one off first, then the second highest, third highest, fourth highest. Now I happen to be a fan of the avalanche method, because it saves you money, but a lot of people can find the snowball method to be more motivating because you're sort of checking the boxes, you've got the first one paid off. OK?

What's the Fed gonna do?

In the never-ending series of "nobody knows," today, three-quarters of economists believe that the next move by the Fed is down. Back in March, not that long ago, two-thirds believed it was up. So all things being equal, I guess it's going to be down? But following the economists will give you whiplash.

More For You

A photograph posted by U.S. President Donald Trump on his Truth Social account shows him sitting next to CIA Director John Ratcliffe as they watch the U.S. military operation in Venezuela from Trump's Mar a Lago resort, in Palm Beach, Florida, U.S., January 3, 2026.

@realDonaldTrump/Handout via REUTERS

Most Popular

- YouTube

In this "ask ian," Ian Bremmer analyzes Trump’s recent meeting with Zelensky and how close (or far) Russia and Ukraine are from a peace deal.

Syrian President Ahmed al-Sharaa attends the military parade of the Syrian army in Umayyad Square in central Damascus to mark the one-year anniversary of the fall of the Assad regime, on Dec. 8, 2025.

Mohammed Al-Rifai/dpa via Reuters Connect

A year ago this month, Syria’s brutal dictatorship collapsed. There are signs of recovery, but sectarian violence threatens to undermine the optimism.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.