April 28, 2020

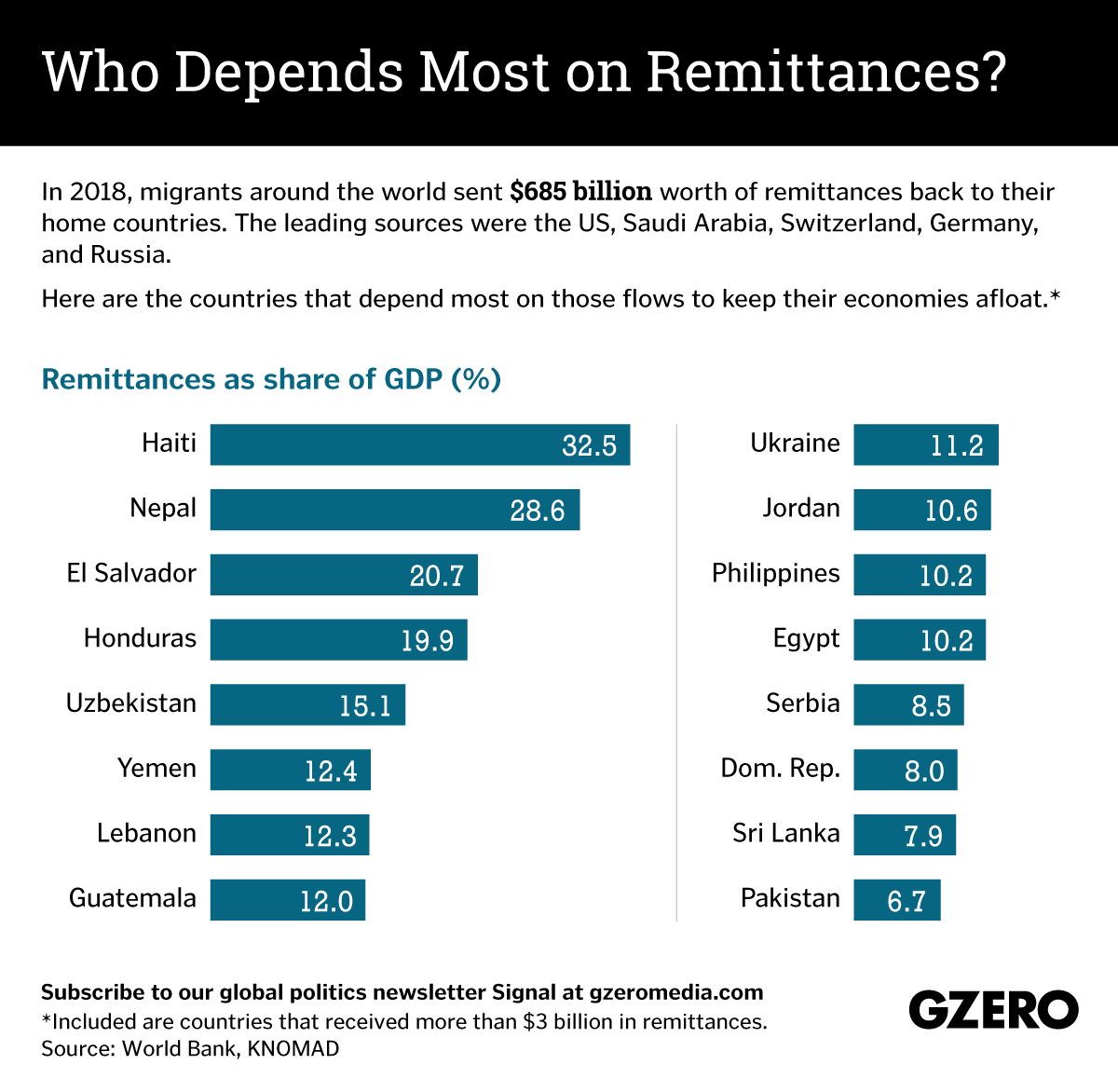

Around the world, hundreds of millions of households and families depend on remittances sent home by migrants working abroad. For many nations, those flows form a sizable chunk of the national economy. But the World Bank has now warned that coronavirus-related lockdowns could slash remittances by as much as 20 percent this year, wreaking havoc on the economies that depend on that cash the most. Consider Haiti, the poorest country in the Western Hemisphere, where remittances account for almost a third of GDP. Or Central American countries like El Salvador and Honduras where the figure is roughly 20 percent. Tiny Lebanon's giant diaspora sends home cash worth 12 percent of GDP, while transfers from Philippine seamen and overseas domestic workers support 10 percent of their home economy. Here's a look at some of the countries that will be hit hardest if global remittance flows grind to a halt because of the coronavirus pandemic.

More For You

- YouTube

As Trump looks for new ways to pressure Tehran, backing Kurdish militants could open a volatile new front—alarming Turkey and risking a dangerous escalation.

Most Popular

Think you know what's going on around the world? Here's your chance to prove it.

The US and Israel have weapons and defense systems that are far more sophisticated than Iran’s. Precision missiles. Advanced radar. Missile defense systems stacked on top of each other.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.