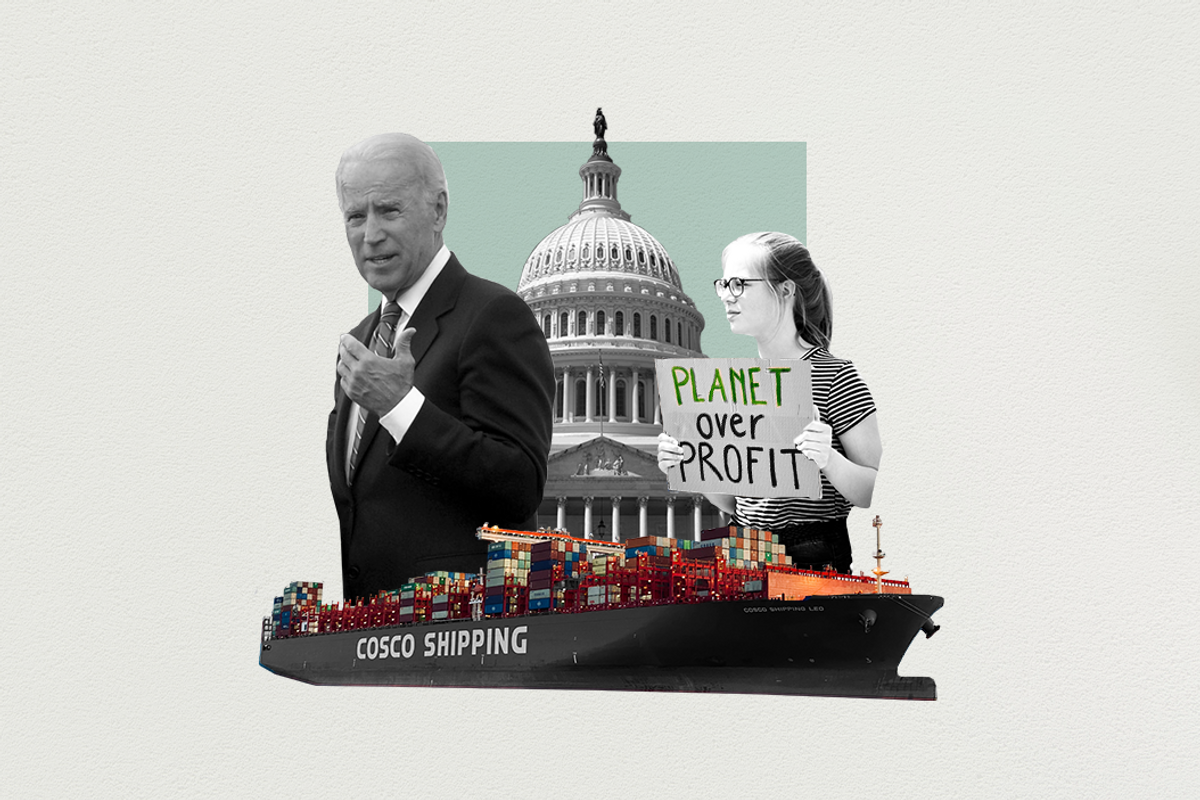

If Joe Biden is elected president next month, how will he change US trade policy? It's a question with serious pocketbook implications for Americans and all US trade partners.

Trade has become more popular in the US in recent years. In 2012, when Gallup asked Americans what "trade means for the United States," respondents were evenly divided between the options "opportunity for economic growth" and "threat to the economy." The more positive view of trade has risen each year since, and when Gallup posed the same question earlier this year, "opportunity" topped "threat" by a margin of 79-18. According to Gallup, this is a point on which Republicans and Democrats agree.

This survey did not focus only on trade in the abstract. Some 80 percent of respondents told Gallup that they consider the USMCA deal, President Trump's update on NAFTA that was finalized earlier this year, to be "good for the country."

Yet, much depends on the makeup of the next Congress and its willingness to renew the Trade Promotion Authority (TPA) —which allows the president to submit a trade deal to Congress for a simple up-or-down vote without the involvement of lawmakers in the deal's details— before it expires on July 1, 2021. Many Republicans will oppose anything that gives a President Biden more power, and many Democrats will insist on a say in the labor, environmental, and climate provisions of any new deals.

So, how might a President Biden approach trade?

The central question centers on China. Though Republicans favor a tougher approach, opposition to Chinese trade practices and theft of intellectual property enjoys bipartisan support, and Biden probably wouldn't move to lower the Trump tariffs quickly or without some concessions from Beijing. That said, escalation of the trade war looks unlikely as Biden tries to put the increasingly combative US-China relationship on a more constructive path.

Biden's different approach to China would also help define US trade policy toward allies. Many European and Asian governments share Washington's frustrations with China's ability to use loopholes in World Trade Organization rules to continue its policy of "state capitalism," China's system of direct state financial and political support for both state-owned and private Chinese companies that compete with foreign firms.

As part of a broader strategy to build a more united international front against China's trade practices, Biden is likely to end President Trump's steel and aluminum tariffs on Europe and to remove the threat of auto tariffs. That would offer a quick boost to Transatlantic relations.

A Biden administration would also move forward on a trade deal with post-Brexit Great Britain, but the end of TPA might delay it indefinitely. Biden is also less likely to threaten trade action against Japan, South Korea, Australia and other Pacific allies, but there are probably too many legislative obstacles for a US return to the Trans-Pacific Partnership anytime soon.

The return of Democrats to power would also mean a return to emphasis on the environmental and climate provisions of any trade deal. That's bad news for those who support a US deal with Brazil, where Jair Bolsonaro continues to enable deforestation in the Amazon.

Bottom line. There are two dominant factors that will shape the Biden trade strategy: His bid to build a more unified international front against China's state-capitalist trade practices, and the limits imposed on his negotiators if, as expected, Congress fails to extend TPA next summer.