VIDEOSGZERO World with Ian BremmerQuick TakePUPPET REGIMEIan ExplainsGZERO ReportsAsk IanGlobal Stage

Site Navigation

Search

Human content,

AI powered search.

Latest Stories

Start your day right!

Get latest updates and insights delivered to your inbox.

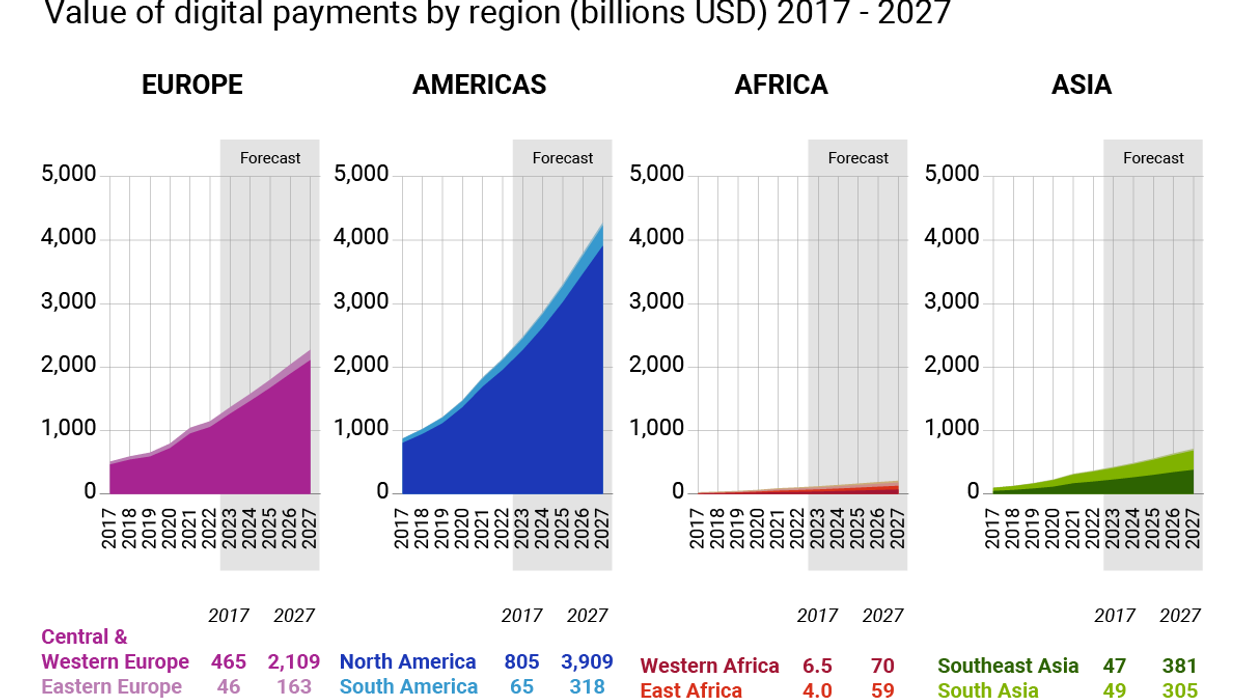

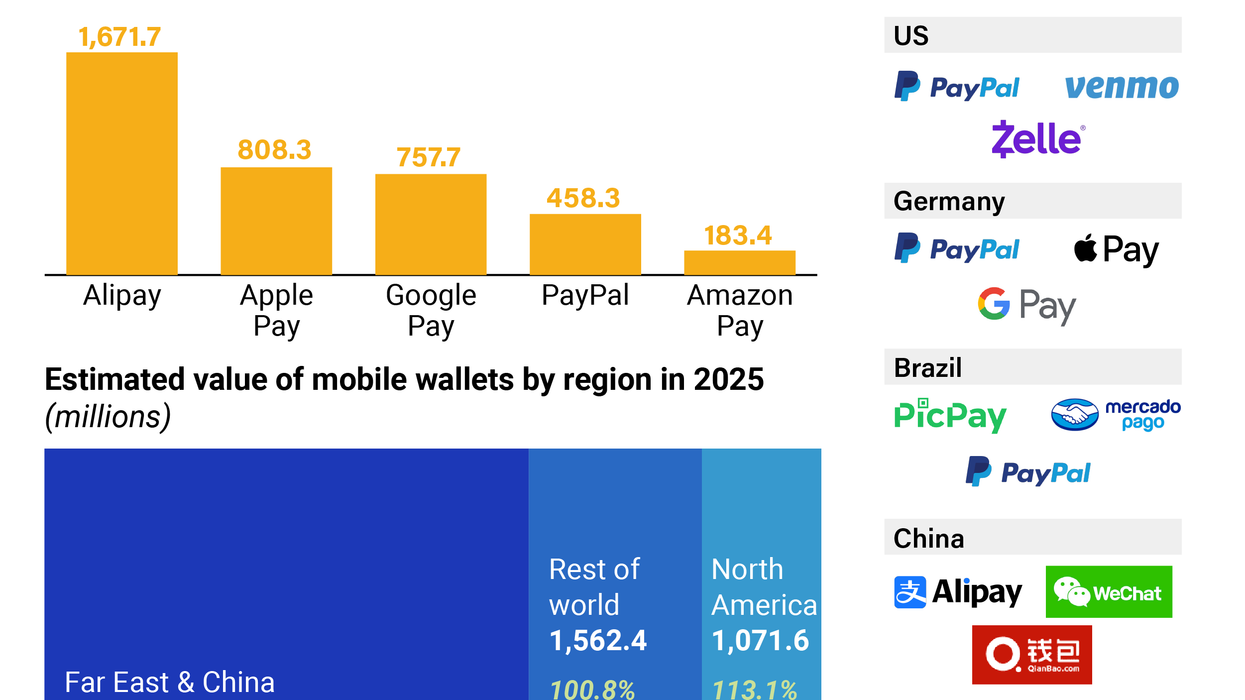

Closing the Gap

How can technology and digital tools help close the inequality gap globally?

Popular

Recent

Load More

GZERO Daily: our free newsletter about global politics

Keep up with what’s going on around the world - and why it matters.