The chip industry is surging on the back of insatiable demand for artificial intelligence. While AMD and NVIDIA have doubled and tripled their stock prices respectively in a single year, there’s reason to believe that AI’s rising tide isn’t lifting all ships.

Semiconductor industry analysts told the Financial Times that the chip boom is mostly focused on AMD and NVIDIA, which make high-powered graphics chips needed to run generative AI systems. That includes the companies’ suppliers, such as the chip fabrication company Taiwan Semiconductor, aka TSMC, and the server company Supermicro.

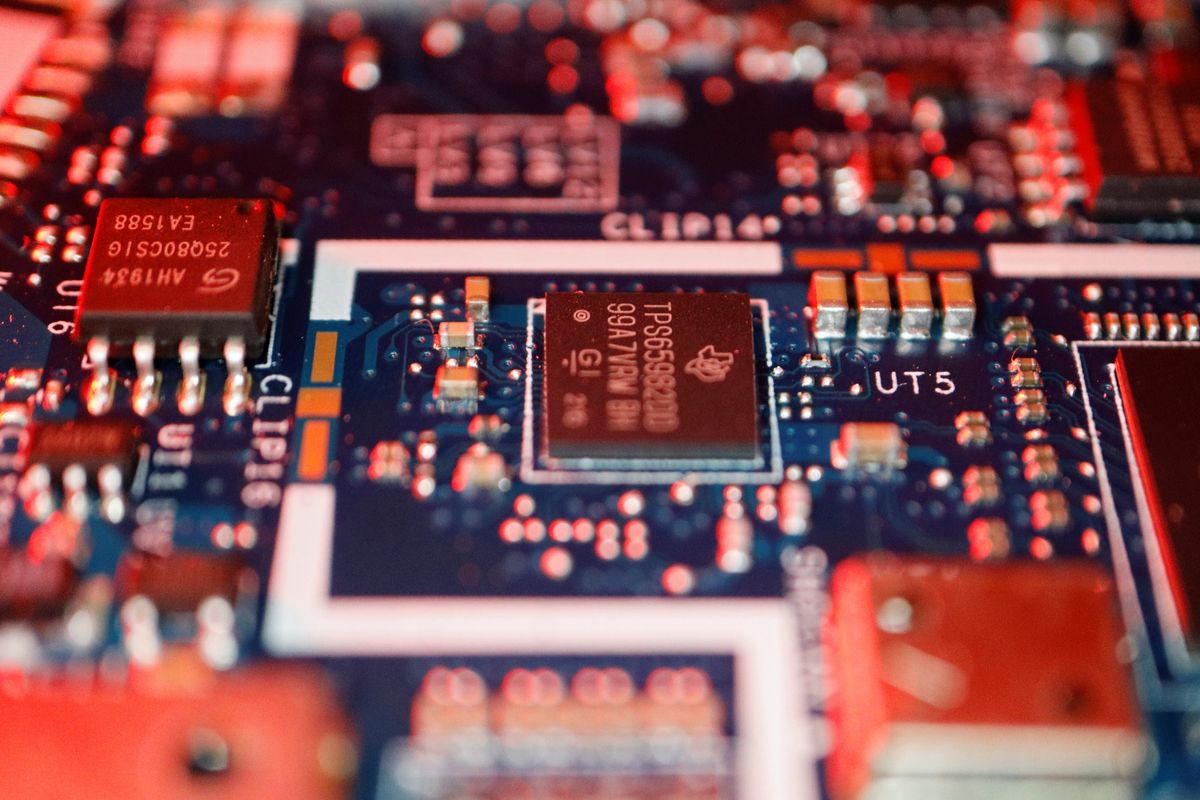

Meanwhile, Intel and Texas Instruments reported disappointing quarterly financial earnings last week, causing most of the sector’s stocks to droop. The culprit: weakened demand outside of AI. Not only was 2023 a down year for computers and smartphones, but there are new concerns about a pullback from automakers and industrial manufacturers.

It’s a far cry from just a few short years ago at the height of the pandemic when chip supply couldn’t catch up to ravenous demand, which made new cars and Nintendo Switches hard to come by.

But it may not be all smooth sailing for AMD and NVIDIA either: New reports indicate Amazon, Google, and Meta — who rely on AMD and NVIDIA chips to power their own AI chips — are investing billions to build their own. It’s not that there’s a chip shortage, really, but there’s a shortage of the right chips.