Fresh out of Barnard College with a degree in political science, Riley is a writer and reporter for GZERO. When she isn’t writing about global politics, you can find her making GZERO’s crossword puzzles, conducting research on American politics, or persisting in her lifelong quest to learn French. Riley spends her time outside of work grilling, dancing, and wearing many hats (both literally and figuratively).

From devastating hurricanes and ceaseless wildfires to catastrophic floods, natural disasters are increasing in frequency and cost in Canada and the US. As climate change makes disasters more frequent and destructive, insurers are having to raise rates and reduce coverage.

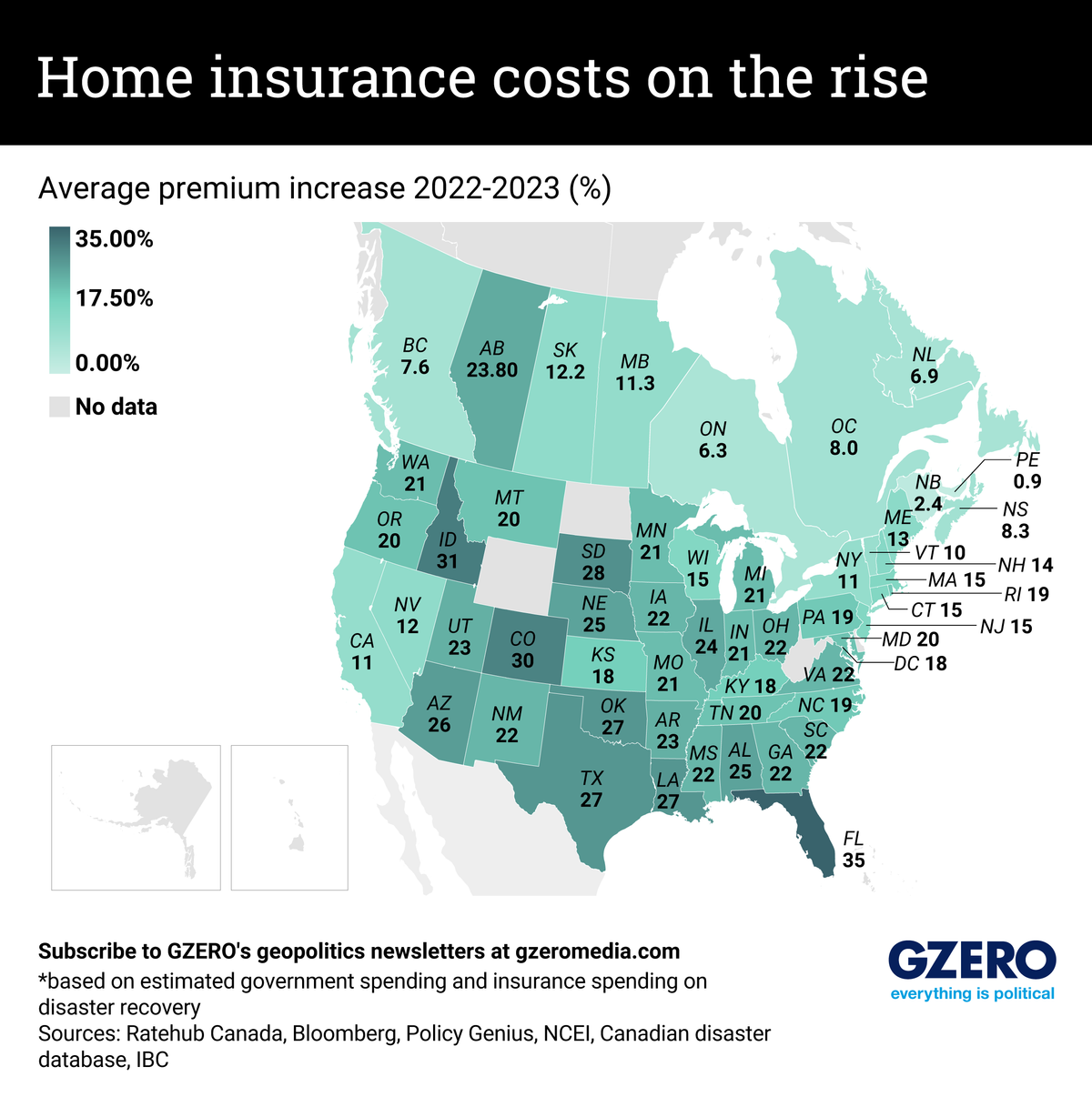

In the US, the home insurance industry has had three straight years of underwriting losses. Insurance rates rose an average of 21% in 2023 as a response, with some insurers in disaster-prone places like California and Florida ceasing to write new policies altogether. As a result, homeowners are forced to pay higher premiums for the fewer insurance options that remain.

In Canada, last summer’s record wildfires compounded with historic floods, costing more than $3.1 billion in insured damage and spiking rates in Alberta, Saskatchewan, Manitoba, and British Columbia.

For this week’s Graphic Truth, we looked at how much insurance rates have risen around the US and Canada.