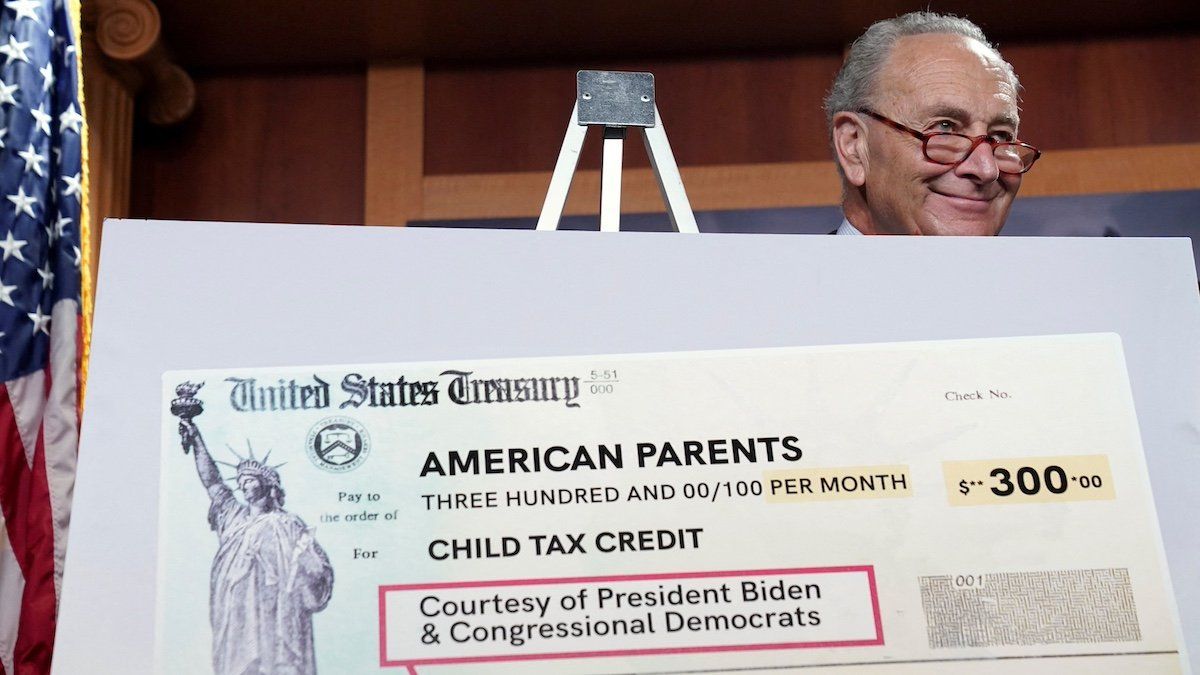

On Wednesday, the House of Representatives passed a $78 billion extension of the popular child tax credit by a large bipartisan majority – but now it faces a rocky road through the Senate, where it may be lumped in with another priority.

What’s in the bill? It aims to extend the credit through 2025, tie the size of disbursements to the rate of inflation, and allow parents to use their previous year’s income if it would result in a higher allowance. The bill also restores certain pandemic-era business tax breaks and curbs the employee-retention tax credit, which many fraudsters exploit.

Even getting to this point looked unlikely, as opposition from both far-right Republicans and certain Democrats forced the House to suspend the normal rules of order and pass it by a supermajority. Cooperating with Democrats on spending is a risk for House Speaker Mike Johnson (R-LA), whose predecessor Kevin McCarthy was booted by his own caucus under similar circumstances.

What happens now? Ordinarily, bipartisan consensus is easier to find in the Senate than in the House, but the child tax credit is unlikely to pass unscathed. Sen. Chuck Grassley (R - IA) put the GOP’s conundrum quite bluntly: “Passing a tax bill that makes the president look good, mailing out checks before the election, means he could be reelected and then we won’t extend the 2017 tax cuts,” due to expire next year. Who said politicians aren’t candid?

We are watching for whether Senate leadership opts to bundle the bill alongside government funding legislation that must pass by March 8, or alongside one of its other major current priorities, like Ukraine aid or a border security package.