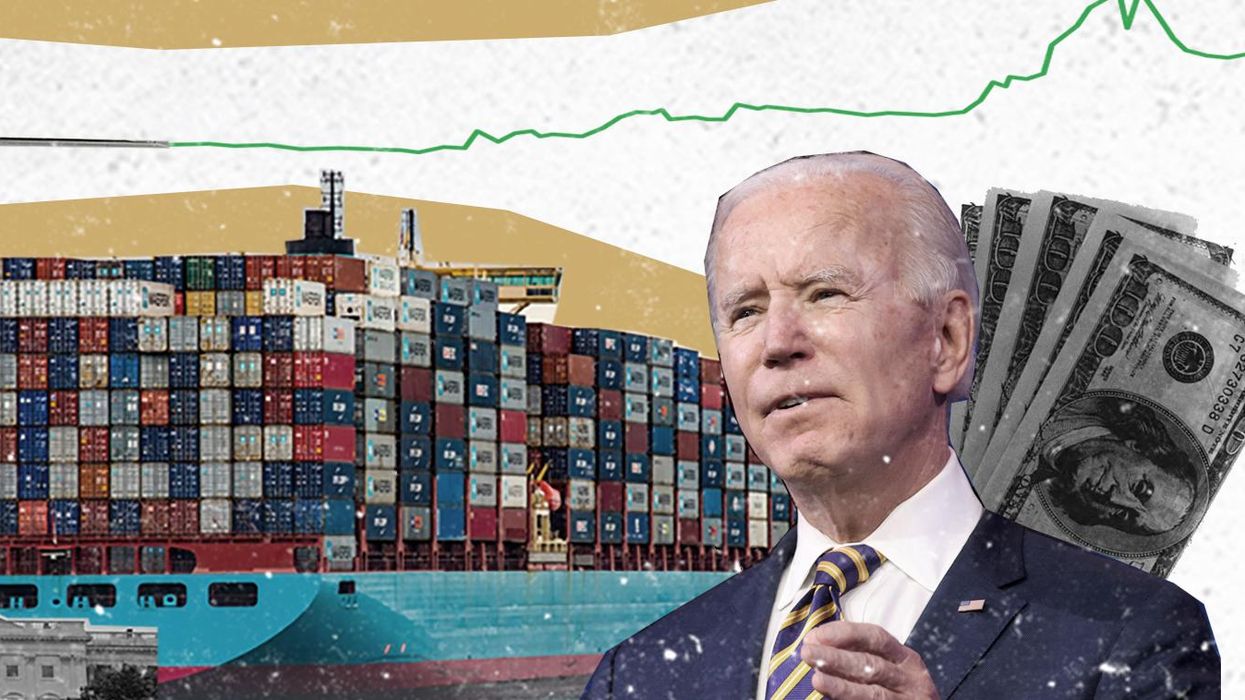

Economy

What We’re Watching: SCOTUS mulling student debt relief, Blinken visiting Central Asia, Biden's partial TikTok ban, Petro’s post-honeymoon phase

US Supreme Court weighs student loan forgiveness; Blinken’s trip to Central Asia; Will China respond to Biden’s government TikTok ban?; First cabinet reshuffle in Petro’s Colombia

Feb 28, 2023