Graphic Truth

Graphic Truth: Burgernomics and how wage growth has outpaced inflation

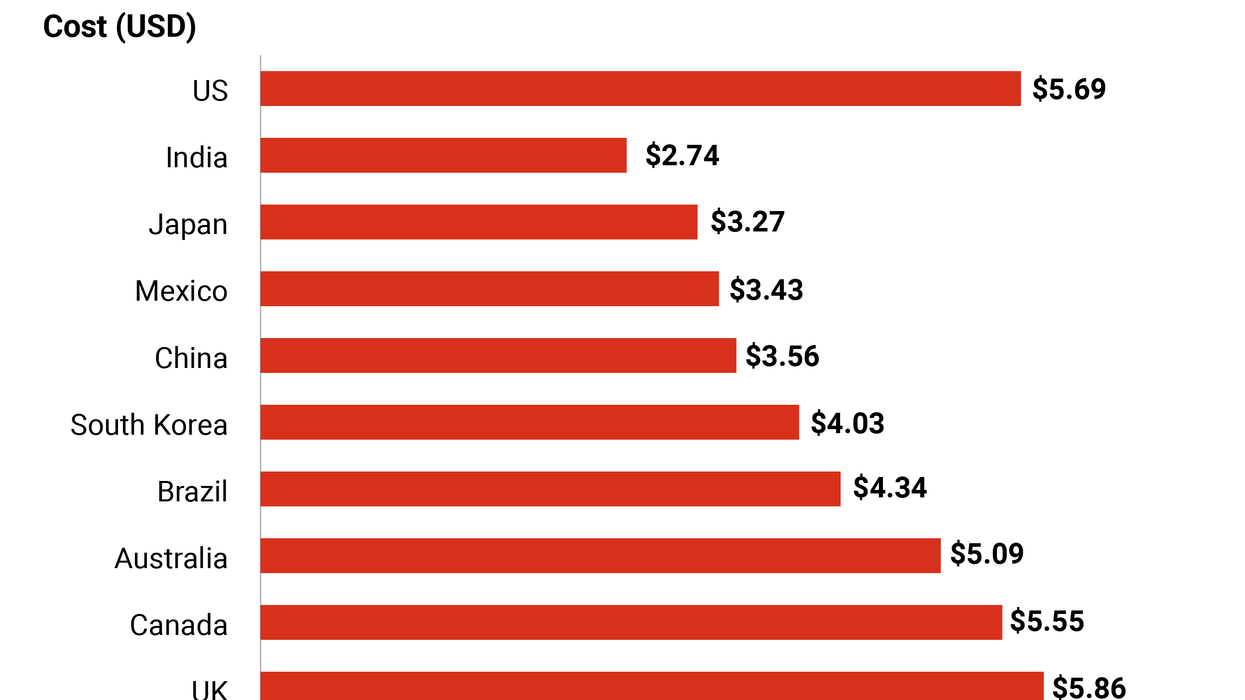

You’ve heard of Bidenomics, but what about burgernomics? Allow us to introduce you to the Big Mac Index, which uses the price of a McDonald's Big Mac to assess whether currencies are over- or undervalued relative to the US dollar. It's also a good measure of inflation – a hot topic for the US election.

Oct 07, 2024