Trending Now

We have updated our Privacy Policy and Terms of Use for Eurasia Group and its affiliates, including GZERO Media, to clarify the types of data we collect, how we collect it, how we use data and with whom we share data. By using our website you consent to our Terms and Conditions and Privacy Policy, including the transfer of your personal data to the United States from your country of residence, and our use of cookies described in our Cookie Policy.

{{ subpage.title }}

Representation of the $Trump meme coin together with Bitcoin and crypto coins, seen in this photo illustration.

Viewpoint: How would Trump’s crypto reserve work?

Though once a crypto skeptic, President Donald Trump has become an enthusiastic supporter of the industry. His media company began investing in crypto several years ago, and on the campaign trail, he pledged to reverse Joe Biden’s administration's tough regulatory approach toward this asset class. He also proposed creating a national Bitcoin stockpile, which would include the Bitcoin seized in law enforcement actions.

Trump’s recent announcement of a “strategic crypto reserve” showed his continued commitment to this idea, as well as his indifference to perceptions of conflicts of interest. Crypto-friendly investors are influential in the new administration, and Trump himself launched a crypto meme coin shortly before taking office.

We asked Eurasia Group expert Babak Minovi how a “strategic crypto reserve” would work.

What do you think the reserve’s purpose would be?

The name implies it would be similar to the Strategic Petroleum Reserve, the 400 million barrels of crude oil the US holds in reserve to supply the country in the event of a disruption. This reserve has also been occasionally used to smooth out the price of oil, most recently with sales in 2020 and 2021 to help moderate post-pandemic price increases. Yet is unclear that crypto is a similarly strategic asset for the US.

Countries also hold other types of assets – usually gold and so-called hard currencies (currencies such as the US dollar that serve as a stable store of value) – for use during times of economic or financial crisis. The US dollar’s status as a global reserve currency allows the US to hold much smaller foreign exchange reserves than the size of its economy would indicate. The US currently has about $1 trillion in reserves, including about $750 billion in gold. In comparison, China has reserves of about $3.2 trillion.

Although speculative assets such as stocks or crypto are generally not included in reserves, allocating some of the US’s reserves to crypto could also be a policy objective of the administration.

What would the reserve mean for the crypto industry?

Given that crypto trading volumes have been around $0.5 trillion a day, it is highly unlikely that any reserve buying envisioned under existing norms would be of sufficient magnitude to affect crypto prices. However, the US Treasury's stamp of approval on crypto as a reserve asset would probably affect market sentiment positively, especially in the short term, by convincing more conservative investors to allocate to the asset class.

There is also the possibility that the US's entry into the crypto reserve bloc could encourage other countries to add crypto assets to their government coffers. El Salvador is another country that has allocated some of its reserves to crypto (though the practice has prompted stern warnings from the International Monetary Fund).

Do you think this is a feasible proposal that is likely to go ahead?

It's hard to say that anything is not feasible these days, given some of the administration’s unexpected early actions, but the wisdom of such a move is questionable. The current downward trend in crypto prices is not outside of historical norms, and its value could sink much more. The relative opacity of the crypto market could also leave these assets more vulnerable to bad actor manipulation, potentially causing ripple effects in financial markets.

Why do you think Trump is advancing this idea and is so bullish on crypto generally?

Though Trump was once dismissive of crypto – he said in 2019 that Bitcoin “was based on thin air” – he later shifted his stance. His deregulatory instincts probably played a role in this shift, as did the influence of people in his orbit. Close advisers such as Elon Musk, Commerce Secretary Howard Lutnick, and Treasury Secretary Scott Bessent – plus some family members – are crypto bulls. Trump’s media company has been dabbling in crypto investments for some time, and his recent experience with the $TRUMP meme coin probably reinforced the idea of crypto’s money-making potential in the president’s mind.

The Biden administration, conversely, took a tough regulatory stance toward crypto – why do you think that is?

In a way, regulators’ concerns with crypto mirror those about any other tradeable asset. Regulators need to be able to establish ownership and price and make sure that investors aren’t swindled by false claims and fraud. The existing regulatory systems have been put in place to ensure the strength and stability of the system for stocks, bonds, foreign exchange, and commodities. A desire to extend that umbrella to crypto – a relatively new asset class – explains most of the tough stance of the previous administration.

Edited by Jonathan House, senior editor at Eurasia Group.

People sit in a restaurant as Argentina's President Javier Milei is seen on television during an interview, in Buenos Aires, Argentina, on Feb. 17, 2025.

Could a crypto scam sink Milei?

Milei promoted a new cryptocurrency called $LIBRA on X last Friday, writing in a now-deleted post that the coin was aimed at “encouraging economic growth by funding small businesses and startups.” Milei also shared a link to something called the Viva La Libertad project, which says it launched the coin “in honor of Javier Milei’s libertarian ideas” and “to strengthen the Argentine economy from the ground up by supporting entrepreneurship and innovation.”

During the brief time Milei’s post was up – just a few hours – the coin’s price soared from nothing to about $5 before plummeting to less than a dollar. People who purchased the token at its highest price were left with a near-worthless coin, while some, including the token’s developers, made off with millions. Though Milei’s office denies any involvement in the coin’s creation or launch, a federal court in Argentina has started an investigation into the scandal, and opposition lawmakers are calling for his impeachment.

While Milei remains popular, he has struggled to pass legislation around his slash-and-burn economic agenda, and this scandal could widen the gulf between the president’s supporters and the opposition. Argentina is in the midst of a massive inflation crisis, which Milei’s shock therapy tactics aim to fix. Being embroiled in a scandal like this is the last thing Milei wants as the country heads into midterm elections this October.Law enforcement officers stand behind yellow tape in a cordoned area, after a Tesla Cybertruck burned at the entrance of Trump Tower, in Las Vegas, Nevada, on Jan. 1, 2025.

Hard Numbers: Cybertruck explosion outside Trump hotel, German fireworks-linked arrests, S&P 500 gains, Crypto loss suspect extradited, Costlier drugs

1: A Tesla Cybertruck exploded outside the Trump International Hotel in Las Vegas on Wednesday morning, killing the driver and injuring several others. Authorities said the vehicle pulled up right to the “glass entrance doors of the hotel," and they are reportedly investigating the incident as a possible terrorist attack.

400: Germans love to set off fireworks in the street to ring in the New Year. But this year, some of these celebrations turned ugly as fireworks were used to attack police officers and firefighters. In Berlin, 30 emergency officials were injured, leading to 400 arrests.

23.3: For the second year running, the US S&P 500 index rose more than 20%, ending 2024 up 23.3%. This neared the 24.2% gain of 2023 and finished the strongest two-year period for the blue-chip stocks this century. Last year’s rise was fueled largely by big tech stocks, particularly those linked to AI, with chipmaker Nvidia’s shares gaining a whopping 172% over the past year.

40,000,000,000: The man suspected of causing roughly $40 billion in crypto market losses in 2022 has been extradited to the United States. On Tuesday, Montenegro sent Terraform Labs co-founder Do Kwon, a South Korean national, to the US to face charges of having deceived investors about the TerraUSD cryptocurrency’s stability.

250: The New Year means new prices for at least 250 medicines, including COVID-19 treatment Paxlovid and Bristol Myers Squibb’s cancer cell therapies, according to research by the firm 3 Axis Advisors. Most of the price rises are below 10%, with the median being 4.5%.Illustration cryptocurrency bitcoin, Suqian, Jiangsu province, China, January 3, 2024.

US regulators give a huge kiss to crypto

The past year and a half has been brutal for cryptocurrencies, as a barrage of bad news, scandals, and bankruptcies fanned suspicions about the credibility of digital coin.

But US federal regulators on Wednesday gave the industry a huge boost of confidence by authorizing some of the world’s largest financial firms to begin offering Exchange Traded Funds (known as ETFs) linked to Bitcoin, the most prevalent crypto currency.

ETFs will enable investors to park their money in funds that contain Bitcoin, rather than investing in the currency itself — this offers a buffer against the volatility associated with buying and selling Bitcoin directly.

Supporters say it’s a huge step towards normalizing cryptocurrencies and opening them up to a wider pool of less risk-tolerant investors. Critics say the move will end in tears as crypto-risks are transfused into the traditional financial sector’s bloodstream.

One person who’s happy about the news? El Salvador’s president Nayib Bukele, who made Bitcoin legal tender three years ago. Anticipation of the ETF decision has pulled his country’s bet on the currency nearly $13 million back into the black in the past few days. Whether that will help to dispel wider questions about the wisdom of his move remains to be seen, but when you’re up you’re up – and right now he’s up.

The dollar is dead, long live the dollar

Every now and then, a story about some country seeking to diversify away from the US dollar kicks off a frenzy about the inevitable collapse of dollar dominance. Lately, there’s been more than a few such headlines, including:

- Russia embracing the Chinese yuan for much of its global trade

- Saudi Arabia considering invoicing oil exports to China in yuan

- France buying gas from China in yuan

- Brazil and China agreeing to ditch the dollar for bilateral trade

- BRICS countries planning to develop a new reserve currency

- Kenya promising to ditch the dollar for oil purchases

- ASEAN members discussing dropping the dollar for cross-border payments

- India settling some trade in rupees

Naturally, these have provided a fertile ground for gold bugs, crypto shills, hyperinflation truthers, techno-libertarians, anti-imperialists (read: anti-US zealots), and run-of-the-mill grifters to stoke fear about the dollar’s imminent death and its supposedly catastrophic consequences for the United States and the global economy.

But even mainstream media outlets and smart, well-meaning analysts have gotten swept into the current wave of hysteria.

Doomsayers offer numerous reasons for the dollar’s demise. They point to everything from China’s meteoric rise to superpower and the emerging multipolarity of the global system, to America’s stagnant productivity growth, chronic fiscal deficits, monetary expansion, growing debt burden, trade wars, financial fragility, and imperial overreach, to challenges from disruptive technologies like central bank digital currencies and crypto-assets.

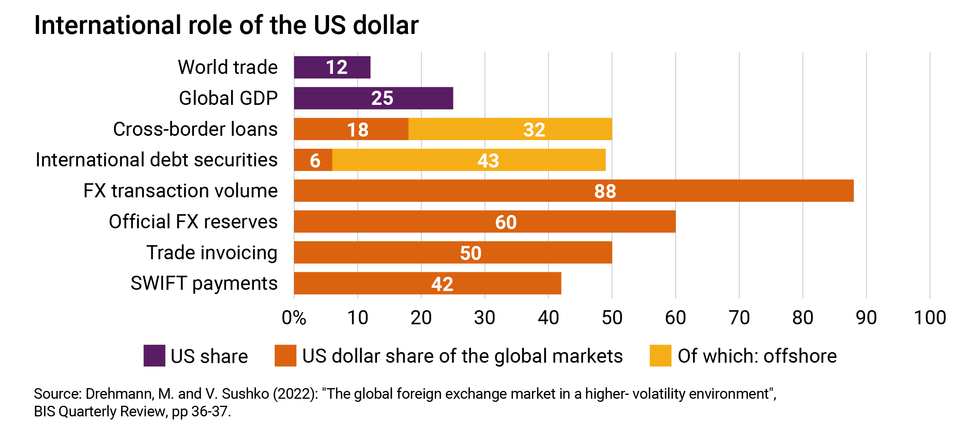

Yet rumors of the dollar’s death are greatly exaggerated. Going by most usage measures, the dollar remains incontrovertibly dominant in global trade and finance, if a little less so than at its apex.

Whereas most currencies are only used domestically or in cross-border transactions that directly involve the currency’s issuer, the dollar continues to be widely used for funding, pricing, trade invoicing and settlement, and cross-border borrowing and lending even when the US is not involved.

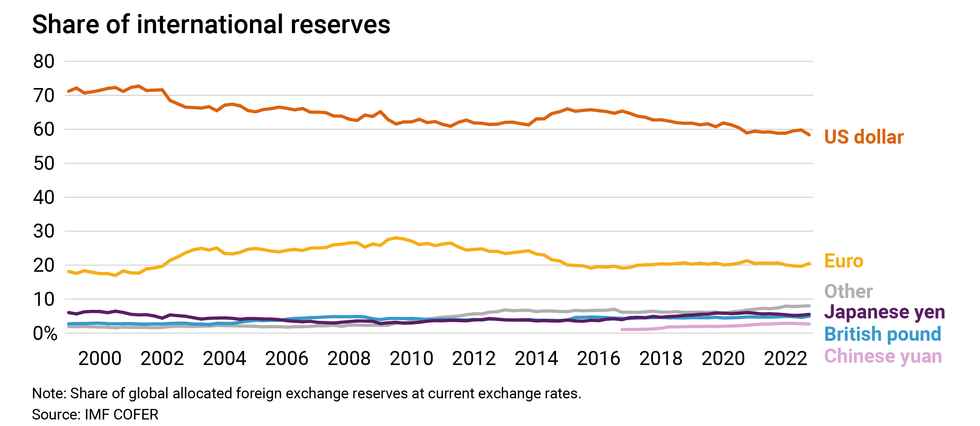

While the dollar’s share of the central banks’ $12 trillion foreign exchange reserves has indeed declined since 1999, it is still nearly twice that of the euro, yen, pound, and yuan combined – the same as it was a decade ago. Its nearest competitor for global currency status, the euro, accounts for barely 20% of central bank reserves compared to the dollar’s 58%, followed by the Japanese yen at 5%. The much-touted Chinese yuan lags far behind at under 3% of foreign exchange reserves.

Even China, in an environment of intensifying geopolitical competition with the US and having just witnessed Washington’s weaponization of the dollar against Russia, has had no choice but to continue accumulating dollar-denominated assets.

Why has dollar dominance remained so sticky? In large part, it’s because incumbency is self-reinforcing. People use dollars because other people use dollars; dollar dominance begets continued dollar dominance.

But it’s not just turtles all the way down. The dollar has inherently desirable features: It is at once highly stable, liquid, safe, and convertible. And US financial markets are by far the largest, deepest, and most liquid in the world, offering an abundance of attractive dollar-denominated assets foreign investors can trade. No other market comes remotely close. As we saw during the recent banking panic, every time turmoil roils global markets, the dollar strengthens as investors flock to the most plentiful and liquid safe assets in existence. In fact, the dollar emerged from the crisis nearly as strong as it’s been in 20 years relative to other major currencies.

Ultimately, investors want to hold dollar assets because America’s economic, political, and institutional fundamentals inspire credibility and confidence. The US has the world’s strongest military, the best research universities, the most dynamic and innovative private sector, a general openness to trade and capital flows, relatively stable governing institutions, an independent central bank, sound macroeconomic policies, strong property rights, and a robust rule of law. People all over the world trust the US government to safeguard the value of their assets and honor their rights over them, making the dollar the ultimate safe-haven currency and US government bonds the world’s most valued safe assets.

None of this means that the dollar’s advantage can’t slip, of course. After all, every reserve currency that came before the dollar was dominant until the very moment it ceased to be.

For much of the 19th century, the global currency of choice was the British pound, owing to the British Empire’s vast territorial reach, economic supremacy, and advanced banking and legal system. It was only definitively displaced by the US dollar once the US had become an economic superpower. Following World War II, US GDP accounted for roughly half of the world total, so it made sense for the dollar to be the global means of exchange, unit of accounting, and store of value.

America’s economic supremacy has since waned, its share of global output now a fraction of what it was in 1945. This trend has led many to worry that the dollar will soon follow in sterling’s footsteps. But there’s a big difference between now and then: When the pound lost its status, there was another currency on the sidelines ready to take its place. Today, there is no such challenger.

Of the putatively serious candidates to dethrone “King Dollar,” the euro is not a viable alternative because of Europe’s persistent fragmentation. Despite having a sizeable economy, well-developed financial markets, decently free trade and capital openness, and generally robust institutions, Europe lacks true capital markets, banking, fiscal, and political union.

Ever since the 2009 eurozone crisis, European bond markets have been much more fragmented and shallower than America’s, leaving investors with a dearth of high-quality euro-denominated assets. While the pandemic did push the EU to finally issue common debt to fund recovery efforts, that move alone was not sufficient to boost the euro’s international role, as markets know that even if full fiscal and financial integration was on the horizon – a big if – political integration isn’t.

The Chinese yuan, meanwhile, is not a viable alternative because of Beijing’s authoritarian and statist bent. In fact, Xi Jinping’s policy preferences – economic self-reliance, financial stability, common prosperity, and political control of the economy – run directly counter to his global-currency ambitions.

Despite its growing role in the global economy and long-standing desire to unseat the dollar, China lacks the investor protections, institutional quality, and capital market openness required to internationalize a yuan that is still not fully convertible overseas. Persistent currency and capital controls, an opaque banking system with too many non-performing loans, spotty contract enforcement, and often arbitrary and draconian regulations will all continue to undermine Beijing’s efforts to elevate the yuan.

Last and most definitely least, so-called cryptocurrencies like Bitcoin are not a viable alternative because they are speculative assets with no intrinsic or legislated value. By contrast, as legal tender, the US dollar is backed by America’s current and future wealth – and by the US government’s ability to tax it.

I say “so-called” cryptocurrencies because these digital tulips are not really currencies or money: they are very expensive and slow to transact in, they can rarely be used to pay taxes or buy groceries, and they are far too volatile to be useful as means of payment, stores of value, or units of account. Nor are they truly decentralized, as the FTX meltdown proved.

To be clear, it’s not completely accepted that losing reserve currency status would be a bad thing for the United States. In the 1960s, France’s then-finance minister Valéry Giscard d’Estaing famously claimed that being the issuer of the global reserve currency afforded America an “exorbitant privilege,” allowing it to borrow cheaply from the rest of the world and live beyond its means.

But there’s a downside (or “exorbitant burden”) to USD reserve status: Foreigners’ insatiable appetite for dollar assets pushes up the dollar’s value, making American exports artificially expensive, harming American manufacturers, increasing American unemployment, suppressing American wages, forcing America to run chronic deficits, and widening American inequality. One could argue that the US should welcome – and, indeed, work toward – a smaller role for the dollar, and that contenders like China and Europe should be loath to replace it.

The most serious threat to dollar dominance might come not from abroad (Europe, China) or from beyond (cyberspace) but from within. The United States is still the most powerful nation on earth, but it’s also the most politically divided and dysfunctional of all the major industrial democracies. The single biggest risk to the dollar’s global status is that growing inequality, tribalism, polarization, and gridlock eventually undermine trust in America’s stability and credibility.

At the end of the day, though, no matter how much the dollar seems to lose its shine, global currency status is about relative – not absolute – advantages. Without a viable challenger, it’s very unlikely that the dollar will lose its special role anytime soon – for better or worse. You can’t replace something with nothing.

___________________

🔔 Be sure to subscribe to GZERO Daily to get the world's best global politics newsletter every day on top of my weekly email. Did I mention it's free?

The Graphic Truth: Crypto's annus horribilis

Crypto bros can't wait for 2022 to be over. The year kicked off with cryptocurrencies riding the wave of the global post-pandemic economic boom. But then Russia's war in Ukraine upended global markets and worsening inflation prompted central banks to start hiking rates, which slashed investors' appetite for risk. What's more, a string of scandals — mainly the collapses of the TerraUSD stable coin and the FTX crypto exchange — undermined overall trust in crypto, leading to the worst annual performance in the industry's history. We track how Bitcoin and Ethereum, which together accounts for more than half of global crypto transactions, have traded since the beginning of the year.

Biden's Africa Summit won't gain influence for US without investment

Ian Bremmer shares his insights on global politics this week on World In :60.

What does Biden hope to achieve from his Africa summit?

Dozens of African leaders in Washington DC, potentially the most stillborn summit the Americans have hosted since the Summit of the Americas, Latin America, in LA months ago, because the United States doesn't have much of a strategy. Certainly want to have more influence given how much the Chinese have been economically locking up so much of the political orientation of these countries. But that means money, and the Americans, this is at the end of the day not the top priority, not even close for the United States, given GDP and given role in the world. So I suspect it's going to be a lot of happy talk. There'll be some political alignment, but it's not going to be a lot of influence.

Why did Putin cancel his annual press conference?

Well, if you were Putin, wouldn't you cancel your annual press conference? I mean, look, they are generally friendlies, and he does control the media, and if you ask something really sharp, that can be it for you and your family. But he doesn't even want the hint of something that may not be scripted. He's been talking about and meeting with, for example, some of the families of the soldiers that are over there, some that have sacrificed, of course, an awful lot, but they've been very carefully vetted. He doesn't want to talk to anyone who's going to be in any way critical, and that's kind of what this annual press conference is like, usually hours long, very voluble. Putin who likes to opine on any topic that is not what you'd be seeing this year, and as a consequence, he's canceling it. It's clearly not a health reason, he's been doing a lot of other public meetings and traveling.

SBF is busted. That's right. At some point he's probably going to end up in jail. What does this mean for crypto exchanges around the world?

Well, it means less investor-friendly regulation for these exchanges. Remember, SBF was giving massive amounts of money to political figures in the United States to ensure that he could capture the regulatory process. That money gone up in smoke, probably have to give it back. And even if they don't, he's not going to have much influence with it from The Bahamas or from prison. And what that means is that a chilling effect on others in the industry. Lots of big questions from major financial institutions as to use-cases for crypto, as opposed to the blockchain, which people are very optimistic about the underlying technology. And again, it means regulations are going to be much more government-oriented, much more citizen protection-oriented, and much less crypto exchange-oriented.

- Russia and the West battle it out in Africa ›

- What We're Watching: EU-Qatar bribery probe, US-Africa talk shop ›

- What do Russians really think of the war? ›

- What We're Watching: Crypto chaos, China-El Salvador trade, inflation across the Atlantic, Biden-Xi meeting ›

- What We're Watching: Bankman-Fried in cuffs, China after "zero," Peru's next vote, Japan's proposed tax hike ›

- Where the US is gaining and losing influence - GZERO Media ›

Logos of FTX and Binance, crypto exchange competitors.

What We're Watching: Crypto chaos, China-El Salvador trade, inflation across the Atlantic, Biden-Xi meeting

Is this crypto’s Lehman moment?

The crypto market’s bad run got even worse this week after FTX, a major crypto exchange, imploded. Headed by billionaire crypto-star Sam Bankman-Fried, FTX was revealed to be in a dire financial position earlier this week, and Binance, the largest exchange and an FTX competitor, considered bailing FTX out, but dropped the idea at the eleventh hour when it became clear FTX was insolvent and its customers couldn’t withdraw assets. Federal investigators are now looking at Bankman-Fried to find out whether his company violated financial regulations. Not only did Bankman-Fried lose more than 90% of his $16 billion fortune in mere days, but the news also sent the broader crypto and stock markets into a tailspin. Bankman-Fried, a big Democratic donor, had been making inroads in recent months with lawmakers on Capitol Hill to shape regulation with favorable terms for the crypto industry. But lawmakers and other crypto lobbyists will now want to distance themselves from the crypto king facing serious allegations of financial impropriety.

China and El Salvador talk trade

China and El Salvador will soon begin negotiations on a free trade deal, Beijing said on Thursday. The relationship is a new one. It was only four years ago that San Salvador cut ties with Taiwan in order to establish formal relations with China. Since then, El Salvador has signed onto Beijing’s ambitious Belt and Road Initiative, and China has agreed – in principle at least – to invest in a number of infrastructure projects in the Central American country, including a sports stadium, water treatment plants, and a $40 million cultural center in the capital. El Salvador’s democracy-flouting President Nayib Bukele needs all the economic help he can get after pinning the country’s economic revival on cryptocurrency, which is clearly not having a very good run. Washington has had to tread carefully with the norm-defying Bukele – China’s bid to rival US influence in Latin America gives the young populist leader options.

Inflation: good news in the US, bad news in Europe

The US economy got some good news on Thursday: Monthly inflation in October dropped to 7.7%, down from 8.2% in September, and is now at its lowest level since January. This suggests that the US Federal Reserve’s ongoing efforts to rein in inflation are working. But across the Atlantic, it's a different story. As the war in Ukraine wages on, inflation remains above 10% in the Eurozone, where the European Central Bank has adopted a more cautious approach to monetary policy out of fear that raising rates too fast could inflict economic pain, particularly on the more sluggish southern European economies. But as cost-of-living pressures persist, thousands of people across Greece, Belgium, and France took to the streets this week to protest “suffocating inflation.” Belgian trade unions say gas prices have gone up by 130% this year, while Greek officials say they’ve risen by more than 300%. European governments are keenly aware that with winter coming, the chill of inflation is only going to get deeper.Putin’s out, but