Trending Now

We have updated our Privacy Policy and Terms of Use for Eurasia Group and its affiliates, including GZERO Media, to clarify the types of data we collect, how we collect it, how we use data and with whom we share data. By using our website you consent to our Terms and Conditions and Privacy Policy, including the transfer of your personal data to the United States from your country of residence, and our use of cookies described in our Cookie Policy.

{{ subpage.title }}

Ukrainian central bank head Andriy Pryshnyy (right) at the 2024 IMF/World Bank Annual Meetings in Washington, DC. Oct. 23, 2024

Ukraine secures fifth round of IMF funding, but less talk of reconstruction

The International Monetary Fund announced Wednesday that Ukraine had successfully completed the fifth revision of its financing program and will receive $1.1 billion to support its non-military budget. This is a major achievement for Kyiv and has required extensive reforms while at war. It’s a war that has not gone well in the last year to boot, and talk about reconstruction — and the IMF and World Bank’s roles therein — has diminished as a result.

Notably absent from this year’s IMF/World Bank Annual Meetings is a marquee discussion of funding for Ukraine’s reconstruction efforts. IMF Managing Director Kristalina Georgieva wrote that Ukraine’s “recovery is expected to slow amid headwinds from the impact of the attacks on energy infrastructure and the continuing war, while risks to the outlook remain exceptionally high.”

Ukraine’s central bank chief Andriy Pyshnyy emphasized the importance of contingency planning under such circumstances, and continuing reforms even if the military situation worsens. Ultimately, they will help Ukraine meet the standards necessary to join the EU — and Kyiv sees greater integration with the West as the best, if not only, way to achieve long-term security.

“Uncertainty is our new reality,” said Pyshnyy at a press event on Wednesday. He credited the IMF’s responsiveness and his own staff’s grit in helping the country overcome panic and anxiety when Russia invaded, and he has set in motion plans to increase the country’s financial resilience.

Maintaining public confidence in the banking system by making sure everyone can access their money when they need it is crucial to keeping the Ukrainian economy afloat. Ukraine’s banks are now capable of functioning in blackout conditions, which has prevented panic withdrawals. The violence has also left many Ukrainians disabled, which has led to changes Pyshnyy said he hopes will lead Ukraine’s “financial system to be the most accessible in the world.”

“We believe in our victory,” said Pyshnyy. “We believe that tomorrow can be better than today.”

Sailboat statue La Vela, on the shoreline at Stresa, Lake Maggiore, Italian Lakes, Piedmont, Italy

Top question for G7: How to Trump-proof Ukraine aid

Ahead of this week’s G7 Finance Ministers’ Meeting in Stresa, Italy, leaders might be feeling a little stress-a’d themselves. With the US election still anyone’s game, the world’s great democracies are increasingly concerned a victory for Donald Trump could severely impact, or even cut off, aid to Ukraine.

With that in mind, they’ll be discussing plans to pass along the interest earned on some $350 billion in frozen Russian assets to fund Kyiv’s war effort — basically making Russia pay to fight itself. If all goes well this week, US officials say some $50 billion could be ready to disburse as soon as this summer. As the assets earn more interest, Ukraine gets more money, and no fiddling with Congress is needed. The European Union is already using a similar set up to fund weapons purchases for Ukraine.

If the details can be hammered out before the G7 Leaders’ Summit next month and implemented before the US election, Trump winning wouldn’t change the payouts to Ukraine. But there’s work to be done: The US, UK, and Canada are reportedly more gung-ho, while Japan, Germany, France, and Italy are still concerned about the long-term precedents their actions could set, possibly driving money from places like China and the Persian Gulf away.

Are markets becoming immune to disruptive geopolitics?

There’s no escaping the intricate link between economics and geopolitics. Today, that link has become a crucial factor in investment decision-making, and who better to speak to that than Margaret Franklin, CEO of CFA Institute, a global organization of investment professionals? Franklin sat down with GZERO’s Tony Maciulis at a Global Stage event for the IMF-World Bank spring meetings this week.

Economists once predicted that sovereign debt would overwhelm global markets. But now, having been through the pandemic, the advent of AI, and wars in the Middle East and Ukraine, “there's almost a level of immunity,” she says, “to the dramatic nature of it until something really cataclysmic happens.”

And then? “The response, generally speaking, has been pretty positive,” Franklin says, with central bank intervention saving markets and building resilience.

In much the same way, the World Bank is trying to boost investor confidence by making changes that leverage private sector capital for public sector goals by better evaluating what level of risk the private sector will accept.

Individual investors should do the same, Franklin advises. “Really evaluate your risk profile … making sure you diversify,” she says, noting that fixed-income offerings have become more attractive. Younger investors, meanwhile, need to be cautious with getting their information on social media, she adds.

For more of our 2024 IMF/World Bank Spring Meetings coverage, visit Global Stage.

Why Africa's power partnership with the World Bank should attract investors

There’s a word frequently used at global convenings like the World Bank Group’s Spring Meetings held this week in Washington, D.C.—multistakeholder. It refers to an approach to problem solving that involves input from a wide range of players—governments, civil society, private sector corporations and investors.

It will take a multistakeholder approach to bring an ambitious new project announced Wednesday to fruition, an initiative to provide electricity to 300 million people in Africa by 2030.

Of the world’s nearly 800 million people living without power, an estimated 570 million are in Sub-Saharan Africa, according to the World Bank. The organization is partnering with the African Development Bank and its own International Development Association to provide up to $30 billion in funding, but is also banking on private sector investment to help make this plan a reality.

At the meetings this week, GZERO’s Tony Maciulis spoke to Lucy Heintz, Head of Energy Infrastructure at Actis Energy Fund, a global investment company focused on sustainability. Heintz expressed optimism in the announcement and explained the reasons why it could be attractive to investors.

“This is a great ambition and it's a huge plan,” Heintz said. “If it's met on the other side by a real intent to do business by government, wherever those governments may be, in those countries where energy access is still lacking, then I think you can start to see the pieces fall into place.”

Heintz explained there are already tools in place that mitigate risk for cross-border private investors, such as the Multilateral Investment Guarantee Agency (MIGA), a World Bank organization that provides insurance for noncommercial political and economic risk.

Success stories already exist globally, Heintz explained, with India being a prime example.

“India has put in place the right legislative frameworks, the right regulation,” she said. “It's also invested in the enabling environment. So, there's a very successful transmission grid investment program, which is led by the government, but then brings in private sector once those projects are de-risked.”

As for concerns about carbon emissions and environmental risk from expanding electricity generation, Heintz says there is a greater danger in not bringing more people to power.

“Reliable electricity supply is fundamental if you want to have any ability to mitigate the risks of climate change, whether it's refrigeration, cooling, the ability to earn a livelihood, it's fundamental,” she said. “I think that's the most important thing to have in mind.”

For more of our 2024 IMF/World Bank Spring Meetings coverage, visit Global Stage.

How to tackle global challenges: The IMF & World Bank blueprint

The International Monetary Fund and World Bank’s Spring Meetings in Washington have told a tale of two economies: In the developed world, inflation is falling, and recession looks unlikely. But many of the world’s poorest countries are struggling under tremendous debt burdens inflated by rising interest rates that threaten to undo decades of development progress. That means these key lenders of last resort have their work cut out for them.

The good news? There’s a proven model, as GZERO Senior Writer Matthew Kendrick discussed with Tony Maciulis at a Global Stage event while reporting on the meetings. Somalia, once the byword for a failed state, managed to implement massive reforms to its financial system to meet the guidelines of the IMF’s Highly Indebted Poor Countries Initiative.

“Because they met those guidelines — while still in a very fragile environment where they were fighting Islamic extremists in the country, dealing with semi-autonomous zones in the north — they managed to discharge 90% of their debt,” said Kendrick. “It's proof that even in very fragile countries, if, as the Somali finance minister said yesterday, you build these projects into nationally unifying efforts to build a better future, they can have tremendous success.”

Kendrick also cited comments from experts calling for the IMF and World Bank to change how they view humanitarian work more generally and not back away from countries amid war. “Conflicts are becoming a day-to-day part of our lives all over the world,” he says. “That means that the IMF and World Bank, in order to make progress on development, have to figure out ways to work with the institutions in these countries as they are also in conflict.”

For more of our 2024 IMF/World Bank Spring Meetings coverage, visit Glogal Stage.

- IMF says economic picture is rosy, but how does it look from the bottom? ›

- Debt limits of rich countries hurt poor countries' growth, says World Bank's Malpass ›

- What We're Watching: Nigerians vote, Biden's World Bank pick ›

- World Bank economist: The poorest are getting poorer globally ›

- With electric bills soaring, should the EU cap natural gas prices? ›

- Why Africa's power partnership with the World Bank should attract investors - GZERO Media ›

Ghana, Accra, 2023-02-16. Young schoolchildren in uniform learning multiplication tables. Illustration image of children in a school in Ghana. A little girl is at the blackboard reciting in front of the class.

To get rich, Ghana needs to wise up

About a quarter of all the chocolate you eat comes from Ghanaian cacao, so with prices at all-time highs, Ghanaian farmers should be raking it in. Instead, they’re selling at fixed prices to a government that’s struggling to settle its debts after a crushing $30 billion default last year.

On Monday, Ghana failed to reach a debt deal to restructure $13 billion in debt, breaching the terms of its International Monetary Fund bailout and pushing the country to the brink. According to the IMF, Ghana is borrowing too much in the same high-interest rate environment that led to the original default. If the government cannot formulate a plan that meets IMF standards, it risks $360 million in upcoming relief.

Nonetheless, the IMF is optimistic that the children of today’s cacao farmers will be driving the global economy in a decade or two. “The 21st century will be the African century,” said economist Michele Fornino on Monday at the IMF/World Bank spring meetings in Washington, DC. He pointed to the increasing numbers of young Africans joining the global workforce, contrasting it with the population slowdowns in Europe, East Asia, and North America that will diminish their economic clout.

But it all depends on getting those kids to school. About one in four children in Ghana is unable to attend school, a rate well below other developing countries. Improving that number will be crucial but difficult if Ghana stays trapped in perpetual cycles of debt and default.

Fornino pointed to South Korea, once among the poorest countries in the world before the vaunted “Miracle on the Han River” transformed it into a wealthy, globally connected society. “South Korean GDP would be one-third of what it is today without the improvements in education that began in 1970,” he said, and the IMF’s long-term goal is to help Ghana and other African countries make the most of similar demographic dividends.

A pedestrian passes a "Help Wanted" sign in the door of a hardware store in Cambridge, Massachusetts.

US jobs soar despite Fed’s high interest rates

A stunning US jobs report on Friday showed that the US economy added a whopping 517,000 jobs in January, far more than the expected 187,000 – taking unemployment down to 3.4%, the lowest it's beensince May 1969. This, coupled with the 11 million US employment openings at the end of 2022, reflects a hopping job market. Experts attribute the surprise figures to there being so much pent-up labor demand that companies continue to hire, though the tech sector has seen a recent slew of layoffs. Job creation has increased in areas like housing and finance, which would normally be more sensitive to high interest rates.

Sounds pretty great, right? Not exactly. The Federal Reserve has been desperately trying to slow the economy and tamp down inflation by raising interest rates, with eight hikes since March 2022. More jobs, however, mean more money being heaped into the economy, so markets tumbled Friday morning as investors anticipated more interest rate hikes in response. That said, the hiring surge may give economists a reason to soften their predictions about a looming recession, or at least about its severity.

Are we entering a post-dollar world?

Are we entering a post-dollar world?

The U.S. dollar reigns supreme among all currencies in global trade and finance.

What does this mean? Only that the dollar is the currency of choice for most economic activities conducted around the world, including those by and between non-U.S. entities. For instance:

- Most commodities and internationally traded goods get priced in dollars

- About half of world trade is invoiced and settled in dollars, far beyond the U.S. economy’s role in global trade

- The dollar is part of nearly all foreign exchange transactions

- Non-U.S. banks lend and take deposits largely in dollars

- Non-U.S. firms predominantly borrow in dollars

- Central banks hold three-fifths of their foreign exchange reserves in dollar-denominated assets, and many choose to peg their own currencies to the dollar

Want to understand the world a little better? Subscribe to GZERO Daily by Ian Bremmer for free and get new posts delivered to your inbox every week.

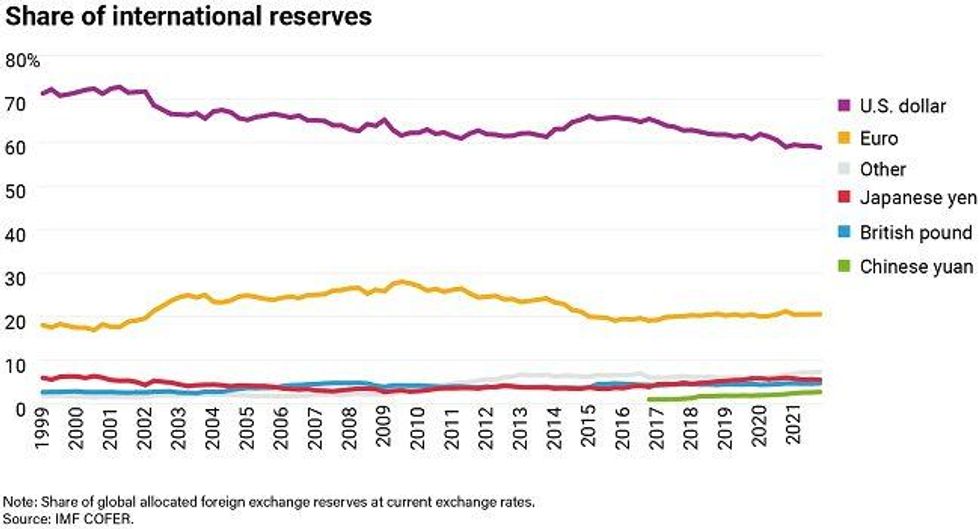

Whereas most currencies are only used domestically and in cross-border transactions that directly involve the currency’s issuer, only the dollar is widely used outside its issuing country. Its nearest competitor for global currency status, the euro, accounts for 20% of central bank reserves compared to the dollar’s 60%, followed by the Japanese yen at 4%. The Chinese yuan lags far behind at about 2% of foreign exchange reserves.

Share of international revenuesIMF COFER

Share of international revenuesIMF COFER

The dollar’s special role did not originate by chance, force, or decree. For much of the 19th century through the early 20th century, it was the British pound sterling that was the dominant global currency. But after World War II, the American economy became dominant in global output, trade, and finance. At the time, U.S. GDP accounted for roughly half of world output, so it made economic sense for the dollar to be the principal global means of exchange, unit of accounting, and store of value.

America’s economic supremacy has since waned, its share of global output now a fraction of what it was in 1945. This trend has led many over the decades to warn about the imminent end of dollar primacy.

Doomsayers from Wall Street and Silicon Valley to Moscow and Beijing offer numerous reasons for the dollar’s allegedly inevitable demise: China’s meteoric rise to global superpower; America’s stagnant productivity growth, out-of-control fiscal spending, unprecedented monetary stimulus, growing debt burden, record-high inflation, protectionist trade policies, and imperial overreach; challenges from disruptive technologies like crypto-assets; and, most recently, Washington’s weaponization of the dollar against its geopolitical foes.

(To be clear, it’s not obvious that losing dollar dominance would be a bad thing for the United States. In the 1960s, former French president Valery Giscard d’Estaing claimed that being the issuer of the global reserve currency afforded America with an “exorbitant privilege,” allowing it to borrow cheaply from the rest of the world, run chronic trade and budget deficits, and live beyond its means. That’s true, but it’s only half of the story. The oft-neglected downside (or “exorbitant burden”) is that outsized foreign demand for dollars pushes up the currency’s value, making U.S. exports artificially more expensive, harming domestic manufacturers, increasing American unemployment, suppressing American wages, fueling speculative bubbles, and widening inequality. Dollar dominance is a boon for Wall Street. For Main Street, not so much.)

Rumors of the dollar’s death, however, are greatly exaggerated.

Going by most usage measures, the dollar remains incontrovertibly dominant, if a little less so than at its apex. Its share of the world’s $13 trillion currency reserves is nearly twice that of the euro, yen, pound, and yuan combined—the same as it was a decade ago. Even China, in an environment of intensifying geopolitical competition with the U.S. and having just witnessed Washington’s freezing of Russia’s international reserves, has no choice but to continue accumulating dollar-denominated assets.

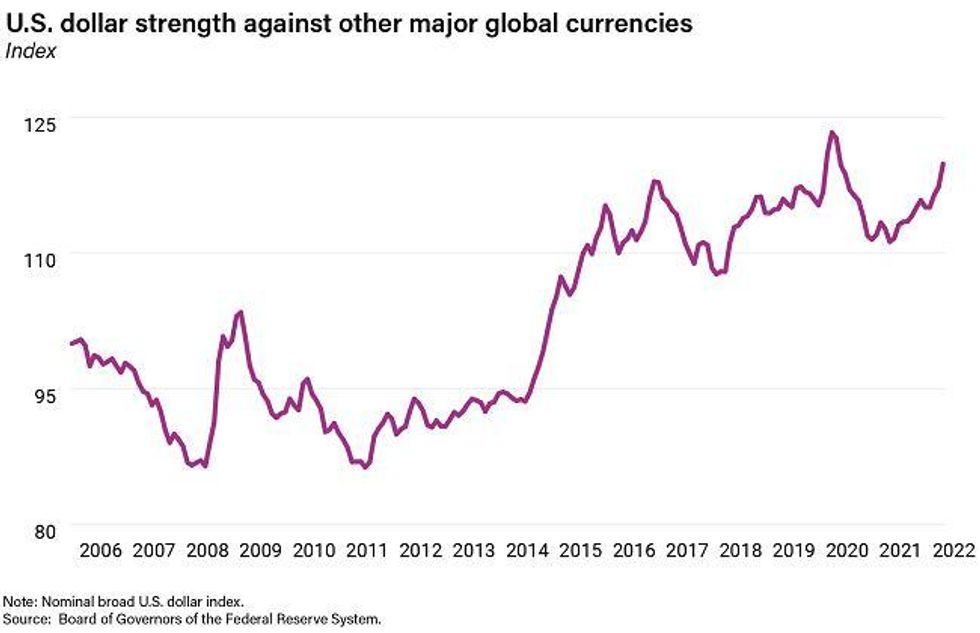

If prognosticators are right that the dollar’s days are numbered, markets—the ultimate judge, jury, and executioner—have yet to find out. As we’ve seen repeatedly and are witnessing now, every time turmoil roils global markets the dollar strengthens, as investors flock to the most plentiful and liquid safe assets in existence. In fact, despite unprecedented sanctions on Russia and 40-year-high inflation prints, the dollar has strengthened more than 10% year-to-date relative to other major currencies and is currently trading at its highest levels in 20 years.

U.S. dollar strength against other major global currenciesBoard of Governors of the Federal Reserve System

U.S. dollar strength against other major global currenciesBoard of Governors of the Federal Reserve System

Why has dollar dominance remained so sticky?

In large part, it’s because incumbency is self-reinforcing due to inertia and network effects. People use dollars because other people use dollars. The more the dollar is used, the more useful it becomes, and the more it is used in response. Dollar dominance begets continued dollar dominance.

But it’s not just turtles all the way down. The dollar has inherently desirable features: it is at once highly stable, liquid, safe, and convertible. And U.S. financial markets are by far the largest, deepest, and most liquid in the world, offering a plethora of attractive dollar-denominated assets foreign investors can trade. No other market comes remotely close.

Investors want to hold dollar assets because America’s economic, political, and institutional fundamentals inspire credibility and confidence. The U.S. has the world’s strongest military, the best research universities, the most dynamic and innovative private sector, a general openness to trade and capital flows, relatively stable governing institutions, an independent central bank, sound macroeconomic policies, strong property rights, and a robust rule of law. People all over the world trust the U.S. government to safeguard the value of their assets and honor their rights over them, making the dollar the ultimate safe-haven currency and U.S. government bonds the world’s most valued safe assets.

None of this means that the dollar’s advantage can’t slip. After all, the pound sterling and all the reserve currencies that came before it were dominant until the moment they ceased to be. Yet in all those cases, there was another currency on the sidelines ready to take their place. Today there’s no such challenger.

Of the serious candidates to dethrone “king dollar,” the euro is not a viable alternative because of Europe’s persistent fragmentation. Despite having a sizeable economy, well-developed and deep financial markets, decently free trade and capital openness, and generally robust institutions, Europe lacks a true capital markets, banking, fiscal, and political union.

Ever since the eurozone debt crisis in 2009, European bond markets have been much more fragmented and illiquid than America’s, leaving investors with a dearth of high-quality euro-denominated assets. While the pandemic did push the EU to finally issue common debt to fund recovery efforts, that move alone is not sufficient to boost the euro’s international role, as markets know that even if full fiscal and financial integration was on the horizon—a big if—political integration isn’t.

The Chinese yuan is not a viable alternative because of China’s autocratic and state capitalist proclivities. Xi Jinping’s and the Chinese Communist Party’s domestic policy priorities—economic self-reliance, financial stability, common prosperity, social harmony, and political control of the economy—run directly counter to their global-currency ambitions.

Despite its growing role in the global economy and its long-standing desire to unseat the dollar, China lacks the investor protections, institutional quality, and capital market openness required to internationalize a yuan that is still not even fully convertible overseas. Persistent currency and capital controls, an opaque banking system with too many non-performing loans, spotty contract enforcement, and often arbitrary and draconian regulations will all continue to undermine Beijing’s efforts to elevate the yuan.

Last and most definitely least, so-called cryptocurrencies like Bitcoin are not a viable alternative because they are speculative assets with no intrinsic or legislated value. By contrast, as legal tender, the U.S. dollar is backed by America’s current and future wealth and by the U.S. government’s ability to tax it.

I say “so-called cryptocurrencies” because these digital tulips are not really currencies or money: they are expensive and slow to transact in, they can rarely be used to pay taxes or buy groceries, and they are far too volatile to be useful as means of payment, stores of value, or units of account. Just since the beginning of the year, the price of Bitcoin has fallen by 60% and the market value of all cryptocurrencies has shrunk from over $2 trillion to well under $1 trillion.

The main threat to dollar dominance might actually come not from abroad (Europe, China) or from beyond (the digital space) but from within. The United States is still the world’s superpower, and it will arguably emerge stronger from the pandemic than any other nation on earth. It’s also the most politically divided and dysfunctional of all the major industrial democracies. The single biggest risk to the dollar’s global status is that growing inequality, tribalism, polarization, and gridlock undermine trust in America’s stability and credibility.

But no matter how much the dollar seems to lose its shine, global currency status is about relative—not absolute—advantages. Without a viable challenger, it’s very unlikely that the dollar will lose its special role. You can’t replace something with nothing.

As Margaret Thatcher might have said, there is no alternative.

🔔 And if you haven't already, don't forget to subscribe to my free newsletter, GZERO Daily by Ian Bremmer, to get new posts delivered to your inbox.