Trending Now

We have updated our Privacy Policy and Terms of Use for Eurasia Group and its affiliates, including GZERO Media, to clarify the types of data we collect, how we collect it, how we use data and with whom we share data. By using our website you consent to our Terms and Conditions and Privacy Policy, including the transfer of your personal data to the United States from your country of residence, and our use of cookies described in our Cookie Policy.

{{ subpage.title }}

Gov. Tiff Macklem walks outside Bank of Canada building in Ottawa.

Are Canada & US headed toward soft landing?

Canada's annual inflation rate dropped more than expected to only 2.8% in June, the lowest figure since April 2021. That's good news, right? Well, it depends.

On the one hand, Canadian inflation is now within the 2-3% range that economists consider healthy, and it remains the lowest rate of all G-7 countries. This means the Bank of Canada might soon move to cut interest rates despite hiking them last month to 5%, the highest level in 22 years. Even if it doesn't, the Canadian economy looks on track for a "soft landing" — economist-speak for avoiding the recession that rate hikes can trigger.

On the other, core inflation — excluding volatile food and energy prices — remains "sticky" (economist-speak for prices that just keep rising whatever the central bank does). This is also happening south of the border in the US, where inflation has receded but things like rent or dining out are getting a lot more expensive.

While Canada's central bank and the US Federal Reserve are often in sync, earlier this year the Bank of Canada famously went off-script by being the first to hit pause on rate hikes. So don't be surprised if Canada goes a step further by slashing rates soon once core inflation is brought under control.

The US, meanwhile, saw 3% year-over-year inflation in June, and economists now predict that Americans may avoid a recession. The US Federal Reserve – likely eyeing Canada’s results – held rates in June but looks likely to raise rates this month from 5% to 5.25%. We’ll be watching to see whether that’s the last Fed hike … and the prospects for a soft landing in the US.A trader works on the trading floor at the New York Stock Exchange.

How’s the US economy doing right now?

If you’re a Republican, you probably think this is the worst economy in American history. If you’re a Democrat, chances are you at least rate it better than when Donald Trump was president.

But the truth is that even if your views weren’t colored by your partisan preferences, there’s enough conflicting data out there to confuse even the best, most apolitical economists.

Thankfully, I’m neither apolitical (I am nonpartisan) nor an economist (political scientists FTW), so if you ask me, I’d say the US economy is … pretty good.

Let’s start with inflation. Unless you’ve been living under a rock, you’ve surely noticed that everything seems to cost a fortune these days. Low and stable for decades, inflation surged in 2021-22 to levels not seen in 40 years thanks largely to the COVID-19 pandemic, which disrupted global supply chains and prompted the government to cushion the fall in incomes with extraordinary stimulus. China’s zero-Covid lockdowns and Russia’s invasion of Ukraine then pushed inflation even higher.

The good news is that inflation has already slowed noticeably, courtesy of the Federal Reserve’s most aggressive tightening cycle in decades. Annual headline inflation is down 4.2 percentage points after declining for 10 consecutive months since peaking at 9.1% last June. Annualized monthly data over the past 3 and 6 months shows even larger declines.

Core inflation – the less noisy measure preferred by economists and policymakers – has proven a bit stickier owing to wild, pandemic-induced swings in the prices of things like used cars and housing. But “supercore” and core services inflation – two measures that strip those components out – have been slowing. All in all, most price measures currently put underlying inflation around 4%.

The bad news is that inflation is still higher than anyone would like it to be, even if it’s at a level that we once found bearable and other countries consider normal. And because inflation has a way of becoming self-sustaining, there are reasons to fear it may prove hard to bring all the way down to the Fed’s target of 2% without causing big job losses.

Which brings us to the labor market. Despite interest rates rising by 5 percentage points in just over a year, unemployment is the lowest it’s been since 1969. Job growth has beat expectations in 11 of the past 12 months, prime-age labor force participation just hit a 15-year high, and people who were out of the labor market before (think older people, people with disabilities and criminal records, parents of young children) are now being pulled into it.

The labor market is so tight that the share of prime-age workers currently employed is higher than it was pre-pandemic, and the total number of people employed is higher than economists expected would be by now before the pandemic began. That includes a record-high share of prime-age women employed and a record-low Black unemployment rate.

It’s not just that everyone who wants a job can get one. Today, for every 10 people who want a job, there are 16 vacancies waiting to be filled. That means for the first time in a long time, American workers have options – including the option to demand a raise or to quit for better pay. Indeed, wages have grown significantly (even though – critically – they haven’t kept up with inflation), and the number of people voluntarily switching jobs remains high by historical standards.

Recent months have seen some softening in labor demand as Fed hikes have begun to hit the economy’s most rate-sensitive sectors, with slowing job growth, a slight uptick in unemployment claims, and more moderate wage growth. If it continues, this could eventually feed into lower spending. For now, though, layoffs show no sign of picking up, and the labor market remains remarkably robust.

What about that recession we’ve been promised?Politicians, economists, and investors have been predicting an imminent recession for more than a year now. The Fed’s rate hikes have to throttle economic activity eventually, the thinking goes, as the tighter financial conditions needed to get inflation down depress credit, spending, and hiring. If you are old enough to remember the 1980s, the story sounds familiar.

Yet despite the highest interest rates in 16 years and a recent spate of banking turmoil, the economy is growing, employers keep hiring more workers to meet Americans’ still-strong demand for goods and services, and recession calls keep getting pushed back.

Sure, there are important pockets of weakness in the economy, such as commercial real estate and high-profile industries like tech, finance, and media. But most of the economy is still chugging along. Corporate profits are near all-time highs, and while consumer spending, retail sales, and industrial production have all slowed somewhat, they remain strong.

Combined with evidence of cooling inflation and healthy but slowing wage growth, this resilience makes me hopeful that the US economy can achieve a “soft landing” – a Goldilocks scenario in which inflation comes down to an acceptable rate (say, under 3%) without a large increase in unemployment or a major recession.

Of course, it’s possible the Fed’s hikes are just taking longer than expected to work their way through the system and will cause a recession down the road. It’s also possible that we haven’t seen the last of the banking stress (plausible), that the US will default on its debt (very unlikely but at least some level of crisis seems necessary to avoid it), or that the Fed will raise rates too much (always a risk).

Any of these could push the US into recession, and indeed, most analysts still expect one to begin sometime in the next year. Then again, they’ve been wrong before. Barring any policy own goals or unexpected external shocks, a soft landing remains a distinct possibility.

So what’s with all the doom and gloom? By some measures, Americans think economic conditions are about as bad as they were during the heights of the Great Recession – when millions of workers had just been thrown out of work, unemployment was in the double digits, and households had lost more than $10 trillion worth of wealth.

This disconnect between reality and perception is quite striking, but it’s not mysterious. To understand it, there are two things you need to know.

First, inflation is much more salient than unemployment. While unemployment imposes severe costs on a small group of people, inflation affects everyone. Bad news also gets more coverage – and sticks more with people – than good news. The corollary is that as far as perceptions go, a strong labor market can’t possibly cancel out the rising cost of living. That’s why only one in five Americans say their financial situation has improved since last year. To the rest, hearing that jobs are plentiful is little consolation when they’re already employed but can’t afford groceries.

Second, partisanship plays a much larger role in shaping public opinion than it did in the past. It used to be that feelings about the economy were determined by the actual state of the economy. But this relationship broke sometime in the last two decades, no doubt thanks to the rise in polarization and the echo chambers created both by social media and by our increasingly politicized news media.

These days, Americans’ feelings about the economy are determined almost exclusively by the president’s politics, independent of the actual state of the economy. The partisan gap in economic perceptions under President Joe Biden and former President Trump has been more than double that under former presidents Barack Obama and George W. Bush. That means virtually half of the country is always bound to be sour on the economy, no matter how good it may be.

Rightly or wrongly, most Americans are feeling down about the economy, and no amount of explainers are about to change that. While for now consumers are still spending like it’s the roaring twenties, there’s always the risk that we’ll eventually talk ourselves into a recession. Perception may not be reality, but when it comes to politics and economics, it’s pretty damn close.

A Canadian soldier holds a flag as they wait for the arrival of PM Justin Trudeau along with NATO Secretary-General Jens Stoltenberg in Adazi, Latvia.

What We’re Watching: NATO (still) wants Canada to pay up, critical mineral gold rush, a tale of two banks

Canada is a NATO laggard – but it’s far from alone

The aging defense league is finding a new raison d’etre battling Russian aggression in Ukraine. But Canada still falls short of the 2% GDP military spending goal that NATO Secretary General Jens Stoltenberg recently said is set “not as a ceiling but a floor, a minimum, that we should all meet.”

A recent NATO report estimates that Canada’s share of defense spending declined against its GDP to 1.27% in 2022, down from 1.32% in 2021 and well shy of the 2% target. Several members spend less than the target, but Canada falls toward the mid-to-bottom of that list.

In 2022, the US topped the list at 3.47% of GDP. The US routinely nudges Canada to spend more on defense. Last month, its ambassador to Canada said he was “hopeful” the country would hit the NATO target.

Canada has no plan to reach the 2% target, and its latest budget is still light on defense spending. But the government does tout that it has the sixth-largest NATO defense budget and is a top contributor to the alliance’s common fund. Canada also spent billions on new fighter jets and is making investments in northern and continental defense. NATO doesn’t penalize states that don’t hit the 2% target – and it’s hard to imagine Canada getting thrown out of the club, so all it can do is name and shame in the hope that Canada starts to pull its weight.

Betting on critical minerals

If you don’t know the term “critical minerals,” it’s time to learn. You’re going to hear it a lot in the years ahead. These are minerals of strategic value to a country’s economic health and security. Both Canada and the US use that definition, but the Canucks add a flourish, referring to them as “the building blocks for the future of our green and digital economy.”

They include copper, graphite, cobalt, lithium, and several others necessary for building and operating a contemporary economy. They power everything, from transportation and energy to digital infrastructure and the so-called “green economy.”

Canada is full of critical minerals. Several provinces and territories are mined for cobalt and copper. Saskatchewan is home to uranium and potash, there’s graphite in Ontario and Quebec, and fluorspar in Newfoundland and Labrador. Experts say the capital-intensive mining industry needs and expects (!) subsidies to extract them. The government’s critical mineral strategy will offer some. PM Trudeau’s March budget included an investment tax credit for critical mineral exploration and investor subsidies.

In the US, meanwhile, the Inflation Reduction Act includes critical mineral measures, such as billions in federal loan money, as well as its own tax credits.

The need for critical minerals is booming on both sides of the border – as is trade. In 2020, mineral trade between the US and Canada hit nearly $96 billion, and by 2030, global mineral trade is estimated to hit $567 billion.

Will Canada and the US hit a recession?

Both the Bank of Canada and the Fed are prepped, but the Northern neighbor is more optimistic than the Southern one. On Wednesday, the Bank of Canada held its interest rate at 4.5%, a move it had signaled for some time. The bank says a soft landing has become more likely as it expects Canada to avoid a recession over the next three years while inflation slows and moves toward the 2% target — though it is still a long way off. The upshot? The economy may be edging back toward a pre-pandemic “normal.” But, warns Bank Governor Tiff Macklem, the current restrictive monetary policy may need to stay in place a while longer. Still, by the gloomy climate standards, that’s pretty darn optimistic.

The US Federal Reserve, meanwhile, is grouchy. It hiked its rate from 4.75% to 5% in March, its ninth consecutive increase. On Wednesday, the US Bureau of Labor Statistics released a report showing that inflation fell to 5%, with core inflation at 5.6%. That’s good news, but it’s unlikely to change the Fed’s course, and another rate hike is expected in May.

So, watch your banks and your dollars for signs of recession. And even if Canada is optimistic, the US pessimism will likely put downward pressure on the Canadian dollar, particularly if Canadian rates remain steady. A weaker Canadian dollar means more expensive imports from the US. But the loonie notably held its own on Wednesday.

What does it all mean in the big picture? Cooling inflation rates in the US, Canada, and Europe offer hope that the rate-hike cycle could soon end. But the UK saw an unexpected inflation jump in mid-March, a reminder to temper — or deflate – expectations.

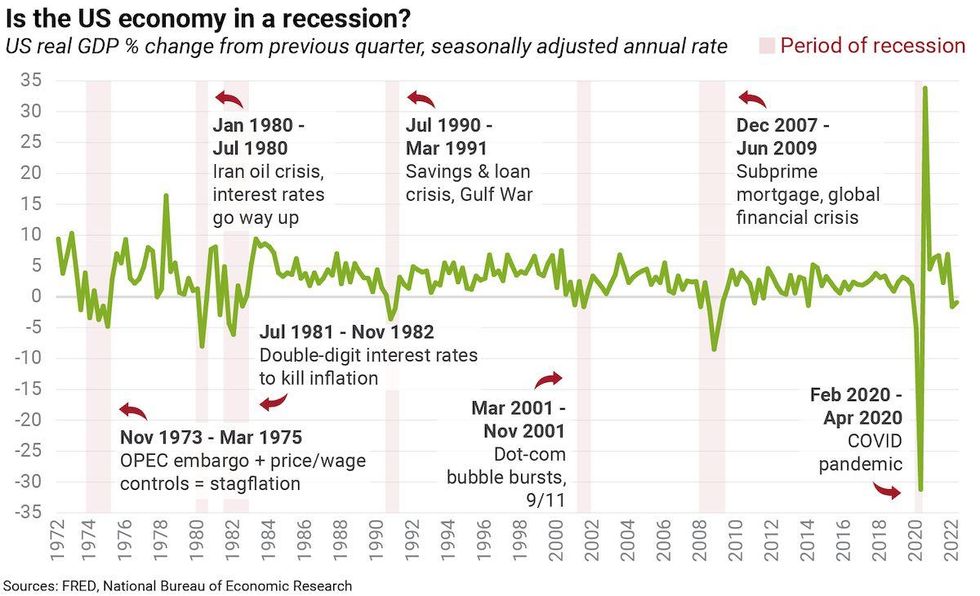

The Graphic Truth: Is the US economy in a recession?

The short answer is: we don't know (yet).

The US economy declined 0.9% in the second quarter of 2022 compared to the previous three months after shrinking 1.6% in January-March, entering, in theory at least, a "technical recession" — economist-speak for two consecutive quarters of economic contraction. But does that make it official? Nope.

Many economists regard that definition as too narrow because it doesn't take into account other indicators beyond real GDP performance. Indeed, the National Bureau of Economic Research, which calls the shots on US economic cycles, says, rather vaguely, that a recession is "a significant decline in economic activity that is spread across the economy and that lasts more than a few months."

To determine what qualifies as a recession, the NBER considers a bunch of other measures of economic activity. These include real wages (minus inflation), industrial activity, or employment — measured by household surveys, not the number of Americans applying for unemployment benefits, now historically low at 3.6% of the workforce.

Also, the NBER takes time to make the call. So don’t be surprised if Americans feel they're in a recession way before the experts decide to label it as such. It’s also possible to have a recession without two consecutive quarters of economic contraction, like in 2001.

In a nutshell: don't buy all the recession chatter for now, but keep an eye out. Even if the Biden administration won’t say the R-word out loud and the Fed still hopes for a soft landing, most economists agree the US economy is more likely than not headed to a recession in 2023, if not earlier.- Podcast: Making sense of global inflation, looming recession, & economists who disagree - GZERO Media ›

- Power to the workers? What historical trends suggest about newfound employee influence - GZERO Media ›

- Winter is coming. Global recession, too? - GZERO Media ›

- The gap between Americans' perception of the economy and reality - GZERO Media ›

Is the U.S. economy in a recession?

Is the U.S. economy in a recession?

Warning: The following piece may change your mind. If all you’re looking for is confirmation of your existing view, read no further.

On Thursday morning, the Bureau of Economic Analysis released data showing that U.S. gross domestic product (GDP) fell at a 0.9% annual rate in the second quarter of 2022. This is the second straight quarter the economy is estimated to have shrunk.

Does this mean we’re in a recession? Not necessarily.

Two negative quarters of GDP growth is sometimes used by analysts and the media as a rule of thumb to call recessions because the two things often go together.

But “often” is not always. You can have a recession without GDP falling for two straight quarters, and GDP can fall for two straight quarters outside of a recession. The pandemic recession of 2020, for example, was the deepest downturn in American history... but it only lasted a month!

And contrary to popular belief, a two-quarter contraction is not the definition used by professional economists or by the U.S. government. Not now, not ever.

Want to understand the world a little better? Subscribe to GZERO Daily by Ian Bremmer for free and get new posts delivered to your inbox every week.

Is the US economy in a recession?FRED, National Bureau of Economic Research

Is the US economy in a recession?FRED, National Bureau of Economic Research

So what is a recession and how do we know if we’re in one?

In the United States, recessions are defined by the National Bureau of Economic Research’s Business Cycle Dating Committee, a non-partisan panel of eight academic economists with no political agenda. They define a recession as "a significant decline in economic activity that is spread across the economy and that lasts more than a few months." In other words, an economic downturn has to be deep enough, broad-based enough, and long-lasting enough to be considered a recession.

The NBER has always explicitly said it does not base its recession calls on GDP alone, in large part because GDP data is mismeasured in real time and initial estimates are subject to continuing—and often large—revisions. This year’s first and second quarter estimates will almost certainly get updated multiple times as better data comes in.

In fact, if history is any guide, there’s a significant chance the real GDP growth number in Q1 and/or Q2 was actually positive. That’s why the NBER only makes recession in hindsight, based on revised data rather than initial estimates.

The NBER is also very clear that it looks at a number of indicators other than GDP, including employment, personal income, consumer spending, manufacturing and trade sales, and industrial production—all of which come out monthly.

How do these measures look right now?

Many are rising slower than before and some are flat, but none are in a clear, significant decline. Consumer spending is still growing. Personal income looks solid. Employment levels, vacancies, and wage growth are holding up. Since the beginning of the year, the unemployment rate has fallen from 3.9% to 3.6% and around 2.7 million jobs have been created.

In short, several key parts of the economy remain quite strong, painting a picture that is inconsistent with what we normally call a recession. Importantly, downturns are usually associated with a run-up in layoffs, and we aren’t seeing that yet. The Sahm rule, another widely used recession indicator that looks at unemployment, is far from being triggered. As Fed chair Jerome Powell said on Wednesday, “there’s just too many areas of the economy that are performing too well” for there to be a recession right now.

That’s not to say the economy is in great shape.

Unlike NBER recession calls, the state of the economy is continuous, not binary. Things are better and worse, not just good or bad. For the typical American, the difference between GDP growth of 2.0% and 1.0% matters more than the difference between 0.1% and -0.1%. There is nothing magical about the 0% threshold.

What today’s GDP release does show is the economy is clearly slowing—or at least some sectors are. We may well be barreling toward a recession, as the IMF believes. That wouldn’t be surprising: we have very low unemployment, high inflation, and significant supply constraints that continue to hold down economic activity. The Fed has signaled its willingness to accept a mild recession to bring inflation down and restore price stability. By design, its rate hikes will over time act to slow demand. That along with other factors (e.g., the Russia-Ukraine war) is likely to cause a recession.

But there’s no evidence we’re there yet.

Of course, just because we aren’t in a recession doesn’t mean the economy is working for people. Inflation is at 40-year highs. Gas, food, and rents are expensive. Wages aren’t keeping up. All of this obviously contributes to the perception that the economy is bad.

That explains why consumer sentiment is in the dumps even as the unemployment rate nears a 70-year low. It also explains why the Biden administration is losing the political argument

Politics are driven by perception, which in turn is shaped by the information environment, partisanship, and confirmation bias as much as by actual economic fundamentals. Recession or not, Americans are feeling down about the economy, and no amount of explainers are about to change that.

Still, facts matter. A cost-of-living crisis is not the same as a slowing or shrinking economy. The economy can have very high inflation at the same time as it adds hundreds of thousands of jobs each month. We can bemoan the former while acknowledging the latter. Calling it a recession doesn’t make it so.

TL;DR: The economy is clearly slowing, although several areas are still growing. The NBER may end up calling a recession sometime down the road. But Thursday’s Q2 GDP release can’t tell us whether we’re in one already.

🔔 And if you haven't already, don't forget to subscribe to my free newsletter, GZERO Daily by Ian Bremmer, to get new posts delivered to your inbox.Biden could get Saudis to push Russia out of OPEC+

Ian Bremmer shares his insights on global politics this week on World In :60.

What does Biden hope to come from his trip to Saudi Arabia?

Well, first he hopes he isn't smashed by progressives in his own party after saying when he campaigned that he wanted to make Saudi Arabia into a pariah internationally. Traveling to Saudi Arabia and visiting with Mohammed bin Salman doesn't do that, but of course, $120 plus oil doesn't do that either. Look, I think it's sensible for him to go. I'm glad he's actually making the trip. In particular, he wants to see the Saudis increasing their oil production beyond present announced quotas to reduce the price. It's impacting Americans at the pump with record levels right now. He'd love to see Russia thrown out of OPEC Plus. I think that's plausible and beyond that, the possibility that Saudi Arabia and Israel would formally open diplomatic relations, an extension of the Abraham Accords which was one of the biggest accomplishments in foreign policy of the Trump administration. Biden's completely aligned with that and I think he's going to try to push on that. So, I do think there will be some direct takeaways from this trip that'll be positive for the Biden administration.

Is the bear market in the United States a prelude to a recession?

Certainly a lot of people think that. I've heard it directly from Larry Summers, I've heard it from Kristalina Georgieva at the IMF. I mean, I would say that a majority of economists out there believe that the United States is heading into a recession. Keep in mind that recessions of the United States come along fairly frequently. So it's not like it's that dramatic as long as it's narrow and it doesn't last very long, but still the mood has turned decidely negative, the level of inflation, the willingness of the Fed to go farther in raising rates and of course the impact on Biden's approval ratings, all of that in firmly fair market territory right now.

Will China's return to mass testing help combat China's COVID problem?

It certainly helps. They need a much greater level of surveillance, but the fact is you now have variants that are vastly more transmissible, infectious. They're closer to measles and that means that unless you are vaccinating everybody, and especially the older and those that are vulnerable from a health perspective, you can't prevent this disease from expanding wildly. What you have to do is make sure the people that get it, don't get really sick. I mean, we just had one bar in Beijing with 50 positive cases in one evening that clearly came from one person that showed up with COVID. That is an environment that doesn't lend itself to zero-COVID. It lends itself to, we have to live with the disease but we have to make sure we're vaccinating people, we have to make sure that we have adequate therapeutic responses. The Chinese are not where they need to be on either of those things. The disease has changed. China's response has not and that means zero-COVID is going to be with them for longer. The economic impact will last longer too.

- More oil? MBS & the moral dilemma ›

- Podcast: Inflation nation: How Larry Summers predicted ... ›

- The Graphic Truth: 50 years of US inflation vs interest rates - GZERO ... ›

- The Graphic Truth: Zero-COVID is hurting China's economy ›

- Biden's trip to Saudi Arabia is about more than pumping oil - GZERO Media ›

- Biden's Saudi Arabia visit is more about strategic partnership than oil - GZERO Media ›

- OPEC+ cutting oil production - GZERO Media ›