Trending Now

We have updated our Privacy Policy and Terms of Use for Eurasia Group and its affiliates, including GZERO Media, to clarify the types of data we collect, how we collect it, how we use data and with whom we share data. By using our website you consent to our Terms and Conditions and Privacy Policy, including the transfer of your personal data to the United States from your country of residence, and our use of cookies described in our Cookie Policy.

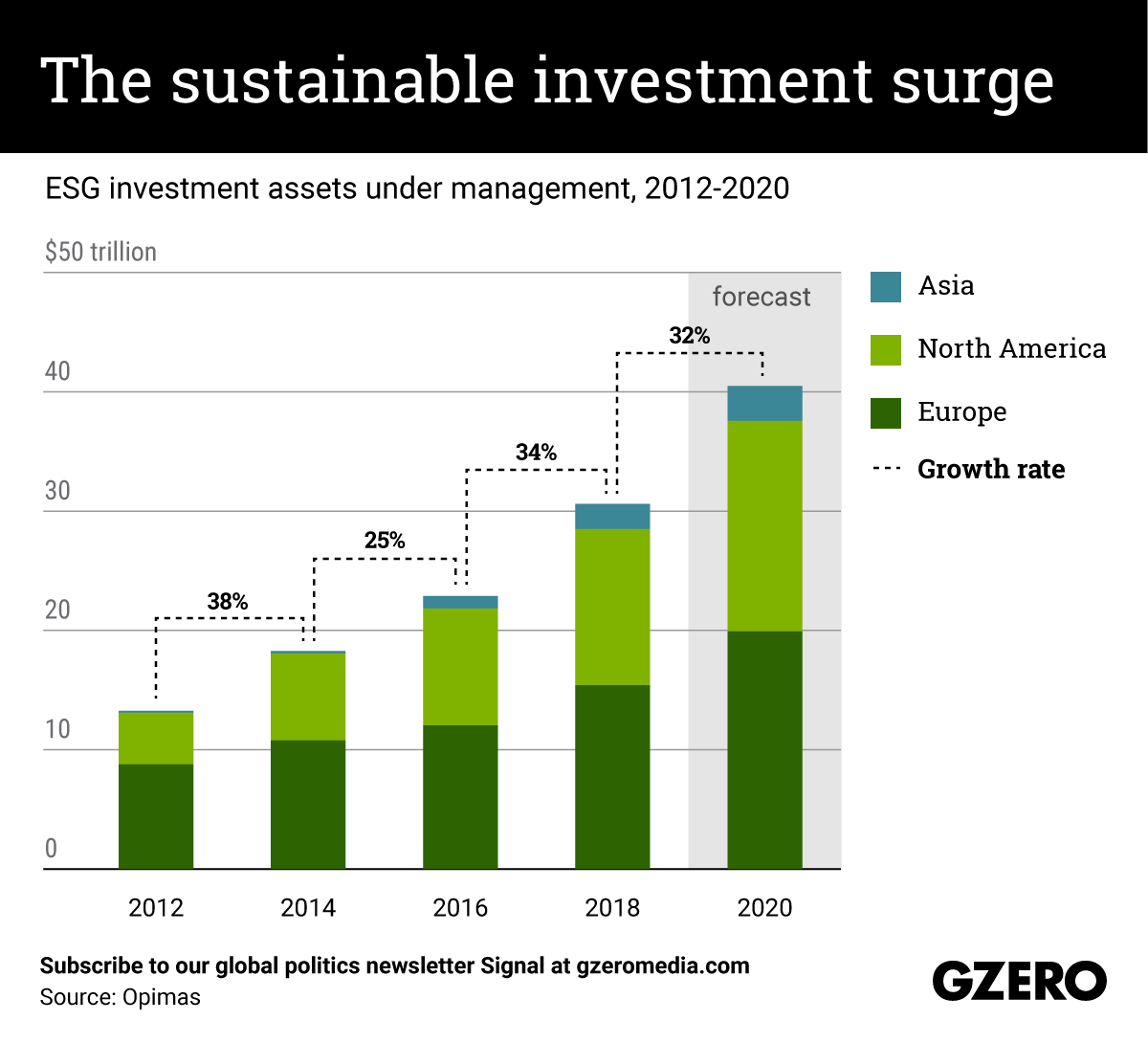

The Graphic Truth: The global sustainable investment surge

As more investors back responsible businesses and funds, the growth of assets under management that are ESG-compliant (under one standard or another) has been soaring in recent years. What's more, the geographic scope of this market is growing. A few years ago it was mainly big in Europe , but it's now picking up fast in the US and expanding to Asia, driving a massive boost this year alone. Why? By throwing a glaring spotlight on global inequality, the thinking goes, the pandemic has been a major driver of investment that focuses less on hard profits and more on socially and environmentally responsible capital management. Will this sustainability surge carry on next year? We take a look at ESG investment's upward trend over the past eight years — globally and by region.