The White House on Wednesday unveiled President Biden’s long-awaited plan to tackle soaring student debt in America, which currently sits at a whopping $1.6 trillion.

What’s in the package? In a one-time deal, the government will cancel $10,000 in federal student loan debt for borrowers making less than $125,000 annually or couples with a joint income under $250,000. Recipients of Pell Grants for low-income undergrads are eligible for an extra $10,000 write-off.

The Biden administration also extended for the last time a pandemic-era pause on payments, which was going to expire on Aug. 31, until the end of 2022. It also wants to cap monthly payments at 5% of earnings. That would cover unpaid interest for Americans who'd owe zero because their income is too low, so their loan balances won’t grow.

Who’ll get the relief? All former students who borrowed money from the government under its higher education financial aid program for college, and current ones who took out a loan before July 1st of this year. With a stroke of his pen, the White House estimates that Biden will wipe out the student debt of some 20 million eligible Americans, almost one-third of the total.

The assistance applies to neither private loans, which account for the lion’s share of accusations of predatory lending, nor to already paid debts, even if they were federal loans.

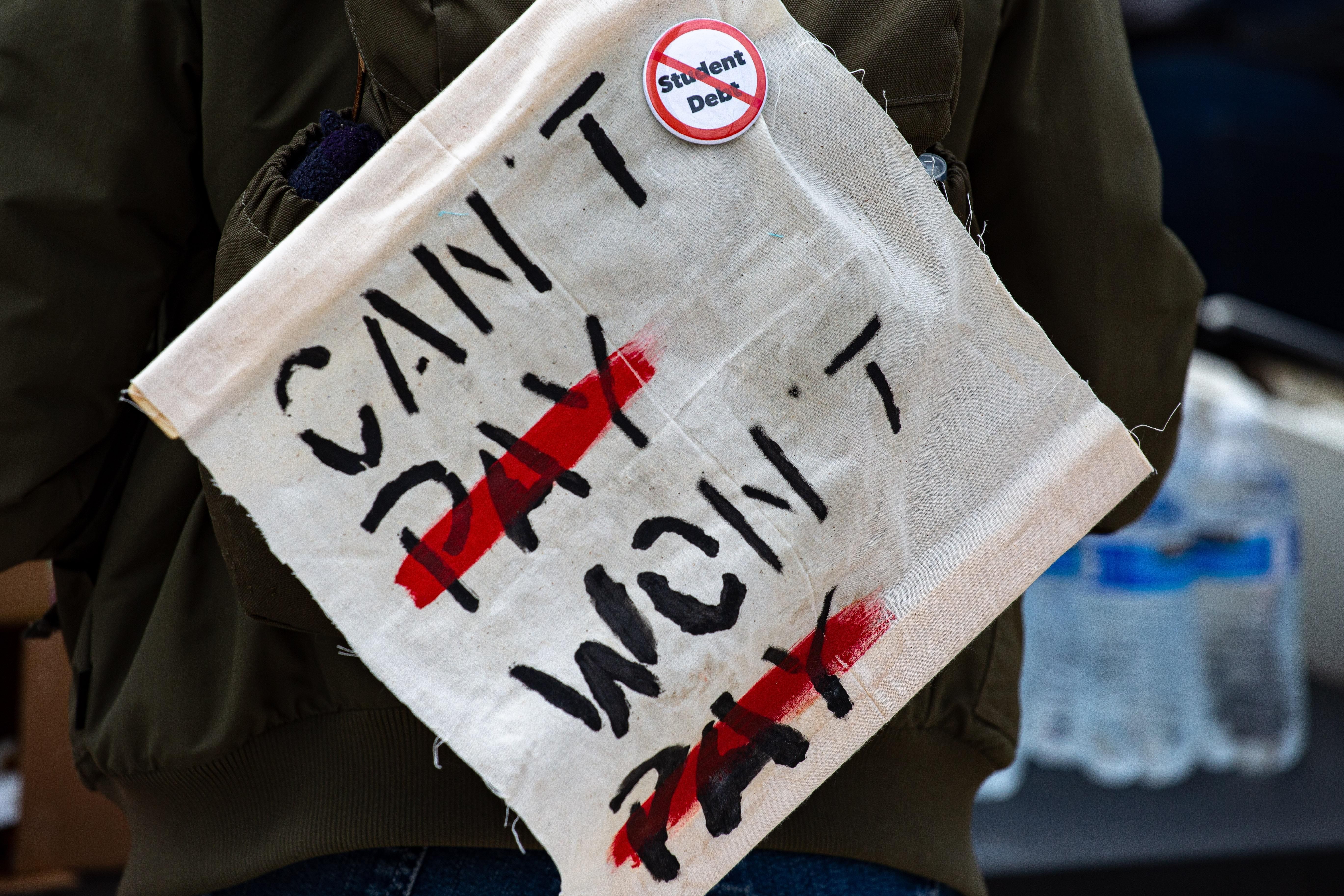

Who's happy? Students who’ll benefit, obviously. That explains why more than a million Americans are now googling “student loans” and searching online for how to apply for debt relief.

Most progressives within the Democratic Party are thrilled, although some senators want Biden to go even bigger and cancel $50,000 per borrower with no income cap. Biden hopes it’ll energize young voters deep in student loan debt ahead of the November midterms, with Dems’ chances looking better than a couple of months ago.

Who’s not so happy? Most economists. Clinton and Obama administration veteran Larry Summers warns that debt forgiveness will further drive up inflation by giving some Americans extra cash to spend when prices are already high.

Who blew a gasket? Many students and their parents who saved money to pay their debt. But mostly the GOP.

"Republicans see the chance to point out that taxpayers are subsidizing the borrowing of college-educated Americans, who tend to have higher lifetime incomes and the most job opportunities," Jon Lieber, US managing director at Eurasia Group, says in this week's US Politics in 60 Seconds.