The US is the world’s biggest debtor, with more than $35 trillion of securities outstanding.

About a quarter of that is held by foreign investors, a detail which has drawn considerable attention since Donald Trump began walloping the world with tariffs to rebalance US trade ties and military alliances. That’s because if countries upset – or merely uneasy – about Trump’s policies sell those securities in response, the debt servicing costs for the US rise. This is no small matter on $35 trillion worth of paper.

In fact, one widely held explanation for Trump’s abrupt suspension of the “Liberation Day” tariffs on April 9 was that wary bond investors had begun to sell US Treasuries: In the week of April 11, yields on 10-year US treasuries saw their biggest leap in a quarter of a century, a sign that creditors were dropping US sovereign debt fast.

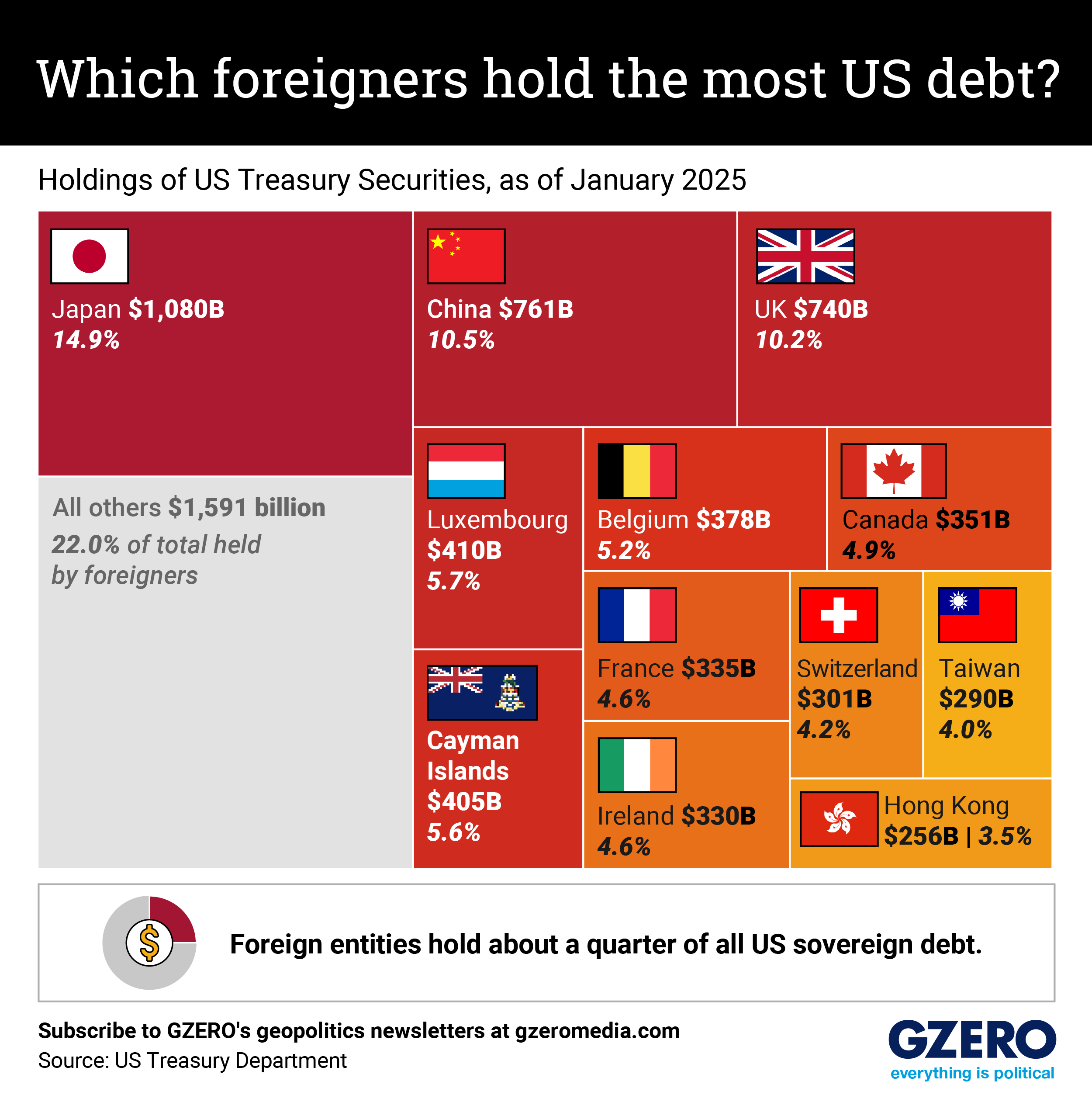

Could countries weaponize US debt more directly? China, Trump’s biggest trade war target, is the second largest foreign US creditor, officially holding more than $750 billion.

A selloff could be devastating. But analysts say it would be hard to find enough buyers for a sale that is both swift and large enough to catch the US off guard.

And even if it were possible, a seller would risk their own financial security as well global economic health by kneecapping the US. In other words: It would be, in financial terms, the nuclear option.

The graphic above looks at which countries hold the most US sovereign debt. Note that the last official data precede “Liberation Day” and that they depend on official reporting. Some countries may hold more than what is listed here via third parties.