March 07, 2024

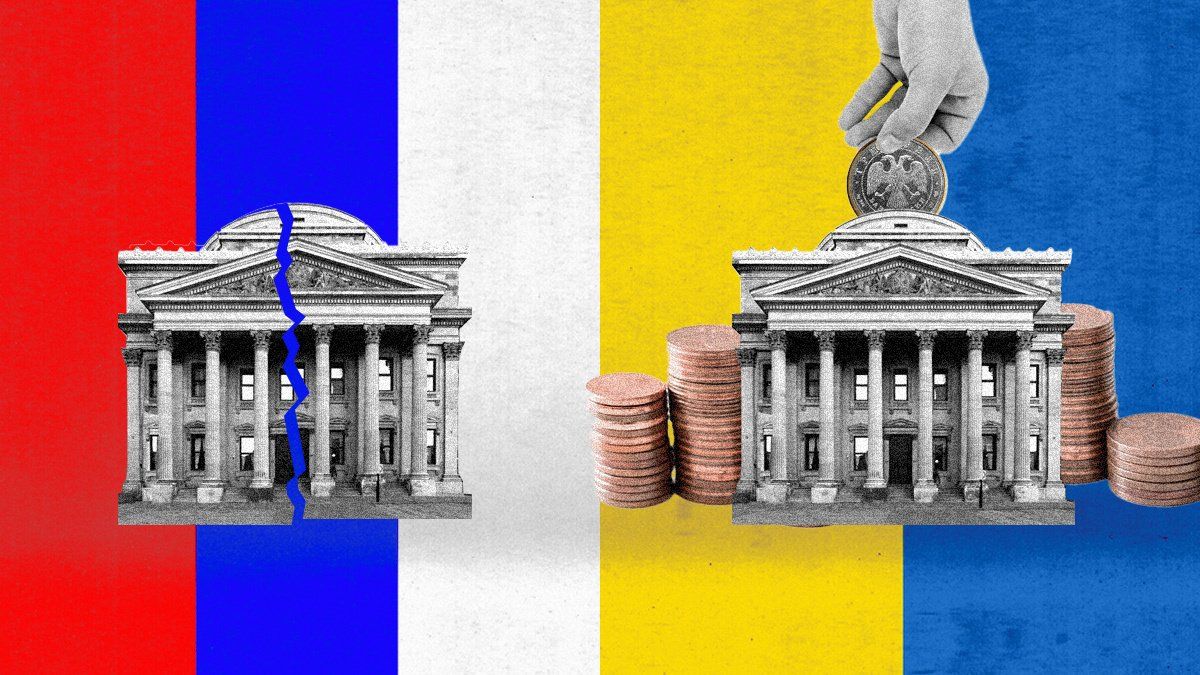

Frustrated by the failure to get a $60 billion emergency aid package to Ukraine through Congress, Joe Biden is working on Plan B.

The president has said that he wants G7 countries to come up with a means of tapping the $282 billion in frozen Russian central bank assets by the time leaders meet in Italy in June.

Even though the meeting in Apulia is more than three months away, it might take at least that long to reach a consensus on how to pluck the goose to obtain the most feathers with the least amount of hissing.

Last week, US Treasury Secretary Janet Yellen said it is important to find a way to unlock the value of those assets and divert the proceeds to help Ukraine’s war effort. She said there is a “strong international law, economic and moral case” for doing so.

Rachel Ziemba, an adjunct senior fellow at the Center for a New American Security in Washington, DC, said this represents an “evolution” in Yellen’s thinking from a previous Treasury Department position that worried about the chilling effect on countries like China that might pull back their assets, in case they were confiscated in the future.

The Congressional gridlock that has held up the emergency aid package to Ukraine has clearly played its part. But Yellen said the monetization of frozen Russian assets is not a substitute for direct aid. “This is something that could help longer term,” she said of the frozen assets.

There is general agreement about the economics and morality of such a plan to monetize Russian assets, but there is considerable disquiet about the legality of seizing them outright.

Since Western countries claim they support Ukraine in defense of the international rule of law, they would be open to charges of hypocrisy if their actions were questionable from a legal standpoint.

Yellen said she did not have a preferred strategy but Canadian Finance Minister Chrystia Freeland was asked about the Treasury secretary’s comments the next day.

She said she spoke to Yellen the previous weekend, and that “She and I agree 100%.”

Canada was the first G7 country to pass legislation to forfeit Russian assets and sell the proceeds to help reconstruct Ukraine. The first cases involved individuals, but Freeland said she has been “centrally involved in the work being done to take the next steps and confiscate (central bank) assets.”

She said she has been working from the principles that aggressors should pay and that Russian President Vladimir Putin should be shown that Western support for Ukraine is not flagging.

The problem is that most of Russia’s central bank assets are being held in Belgium, and some European Union countries, including Germany and France, remain unconvinced that simply grabbing the assets and selling them off is a good idea. The EU wants Europe to be seen as a safe place for people to invest their assets, without fear of confiscation.

Clifford Sosnow, chair of international trade and investment at Canadian law firm Fasken, has been a critic of the original legislation introduced by Ottawa on the grounds of due process and compliance with international law when it comes to confiscation without compensation.

“Generally, international law takes a dim view of this. So, while the impulse is understandable, and I have no sympathy for the invasion of a sovereign country, itself a violation of international law, I question whether the house that Canada has built to prosecute and take assets is built on solid legal foundation,” he said.

France, Germany, and the European Central Bank have expressed concerns about legality, as well as fears about the prospect of Russian retaliation on European assets and the impact on the euro’s status as a reserve currency.

The Europeans are pushing a less ambitious project, using what European Commission President Ursula Von Der Leyen called “the windfall profits” from Russian assets that could be used to purchase military equipment for Ukraine. More than $200 billion is held in Belgium by Euroclear, a financial service company that holds for safekeeping. Euroclear earned $4.78 billion in 2023 from those assets.

There have been suggestions that the EU issue bonds based on the income from the Russian assets.

But Ziemba said the view in Washington is that this would not yield enough funds. She said Canada, the US, and the UK are coalescing around the idea that the assets be used as collateral and used to issue loans to Ukraine.

Under this plan, Ukraine’s claim for reparations from Russia would be syndicated to its allies in return for a loan. If Moscow refuses to pay damages, the allies could then use Russia’s frozen assets to pay off the loan.

While loan guarantees might also have to work their way through Congress, this proposal might have broad support: Donald Trump has spoken favorably about loans, rather than direct aid, as a means of supporting Ukraine.

However, questions remain about the legitimacy of grabbing someone else’s assets, even if you don’t auction them off.

Lenders would still have a contractual claim on the Kremlin’s reserves.

The World Bank has estimated the cost of rebuilding Ukraine at $486 billion, but the legality of Kyiv setting its own reparations invoice is dubious.

Given the hurdles, Biden will be lucky if he gets unanimity by mid-June.

More For You

- YouTube

In this Quick Take, Ian Bremmer examines what may come next in the US-Israel war with Iran as the Trump administration signals significantly larger military operations ahead.

Most Popular

FILE PHOTO: Canadian Prime Minister Mark Carney and India's Prime Minister Narendra Modi shake hands before posing for a photo during the G7 Leaders' Summit in Kananaskis, in Alberta, Canada, June 17, 2025.

REUTERS/Amber Bracken/File Photo

Indian Prime Minister Narendra Modi and Canadian Prime Minister Mark Carney struck a series of deals during a meeting in New Delhi on Monday, including a 10-year nuclear energy deal under which Canada will provide India with uranium.

A satellite image shows black smoke rising and heavy damage at Iranian Supreme Leader Ayatollah Ali Khamenei's compound, following strikes by the United States and Israel in Tehran, Iran, on February 28, 2026.

Pleiades Neo (c) Airbus DS 2026/Handout via REUTERS

Supreme Leader Ali Khamenei is dead, the conflict is spreading, and US President Donald Trump still isn’t clear on who he wants to run Iran.

Shipping in the world’s most crucial oil chokepoint has nearly ground to a halt after at least four tankers were targeted in Iran’s retaliation to US and Israeli strikes on Saturday.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.