January 08, 2019

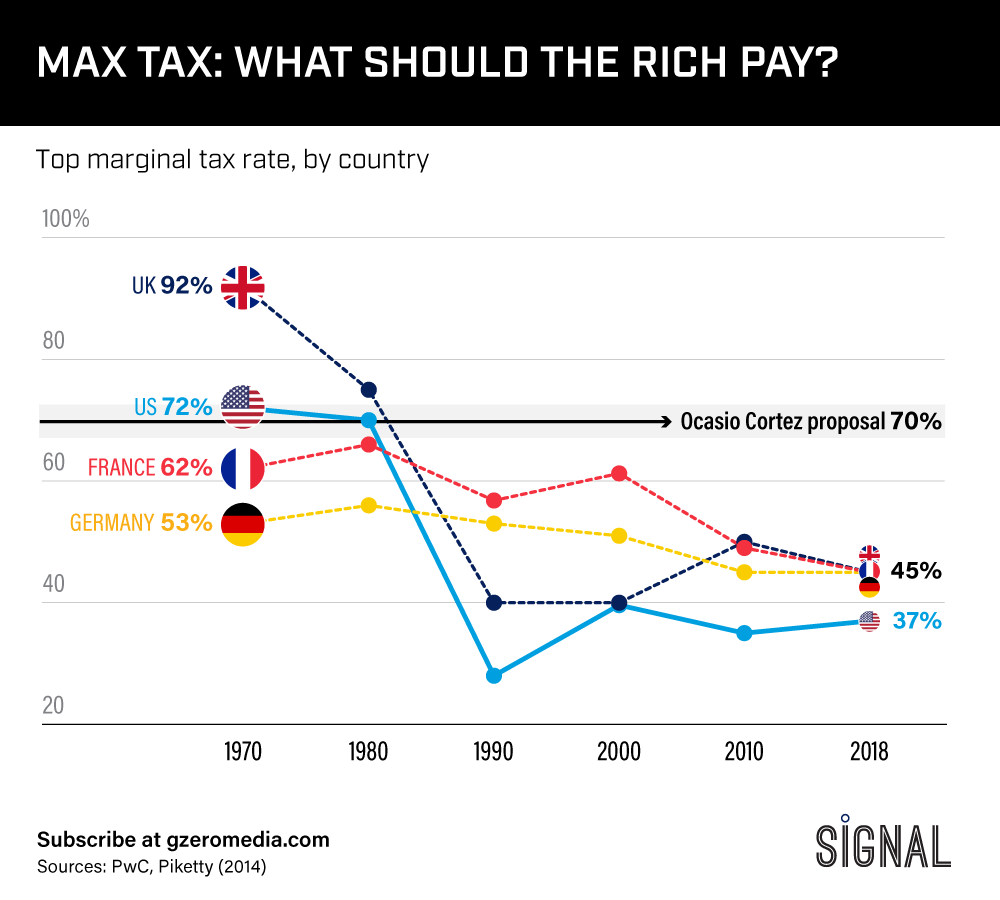

Freshman US Congresswoman Alexandria Ocasio-Cortez made waves in recent days with her suggestion that the US raise its top marginal tax rate to 70 percent for income over $10 million dollars.

To clarify, this does not mean taking 70 percent of everyone's income. It means the government would take 70 percent of any income above $10 million dollars. Currently the top tax rate in the US is 37 percent, but just a few decades ago it was nearly twice that level. Here's how top tax rates have evolved since 1970 in some of the world's largest economies.

More For You

As expected, the Supreme Court struck down the bulk of Donald Trump's sweeping “Liberation Day” tariffs as illegal … and almost nothing changed.

Most Popular

What's Good Wednesdays

What’s Good Wednesdays™, February 25, 2026

Sponsored posts

Small businesses at a crossroads

Chris, an Army veteran, started his Walmart journey over 25 years ago as an hourly associate. Today, he manages a Distribution Center and serves as a mentor, helping others navigate their own paths to success. At Walmart, associates have the opportunity to take advantage of the pathways, perks, and pay that come with the job — with or without a college degree. In fact, more than 75% of Walmart management started as hourly associates. Learn more about how over 130,000 associates were promoted into roles of greater responsibility and higher pay in FY25.

Ukraine's President Volodymyr Zelenskiy, Finland's President Alexander Stubb, Estonia’s Prime Minister, President of the European Commission Ursula von der Leyen and other European leaders visit memorial to fallen Ukrainian defenders at the Independent Square on the fourth anniversary of Russia's full-scale invasion, in Kyiv, Ukraine February 24, 2026.

Ukrainian Presidential Press Service/Handout via REUTERS

Somewhere in the Donbas region, Ukrainian soldier Artem Bondarenko says he hasn’t slept through the night in months as he defends Eastern Ukraine.

- YouTube

In the latest episode of Vladimir Putin and Xi Jinping's hit wellness podcast This Authoritarian Life, we learn how positive communication patterns can break negative cycles in our relationships -- especially our relationships with Iran, Syria, Venezuela, and Cuba. #PUPPETREGIME

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.