The situation in Ukraine is evolving at lightning speed. After the Kremlin recognized the independent status of Donetsk and Luhansk, two breakaway regions in eastern Ukraine, the EU and US responded on Monday with strongly worded statements and tepid sanctions.

But Washington and Brussels both upped the ante on Tuesday after Russian tanks began rolling into the Donbas region, a sign, some analysts say, that the days of shuttle diplomacy are over. This was reinforced by Sec. of State Tony Blinken saying Tuesday that a Thursday meeting with his Russian counterpart had been canceled. By Wednesday, Kyiv was urging its citizens to leave Russia immediately.

What sanctions are currently in place and what might this mean for Russia’s economy?

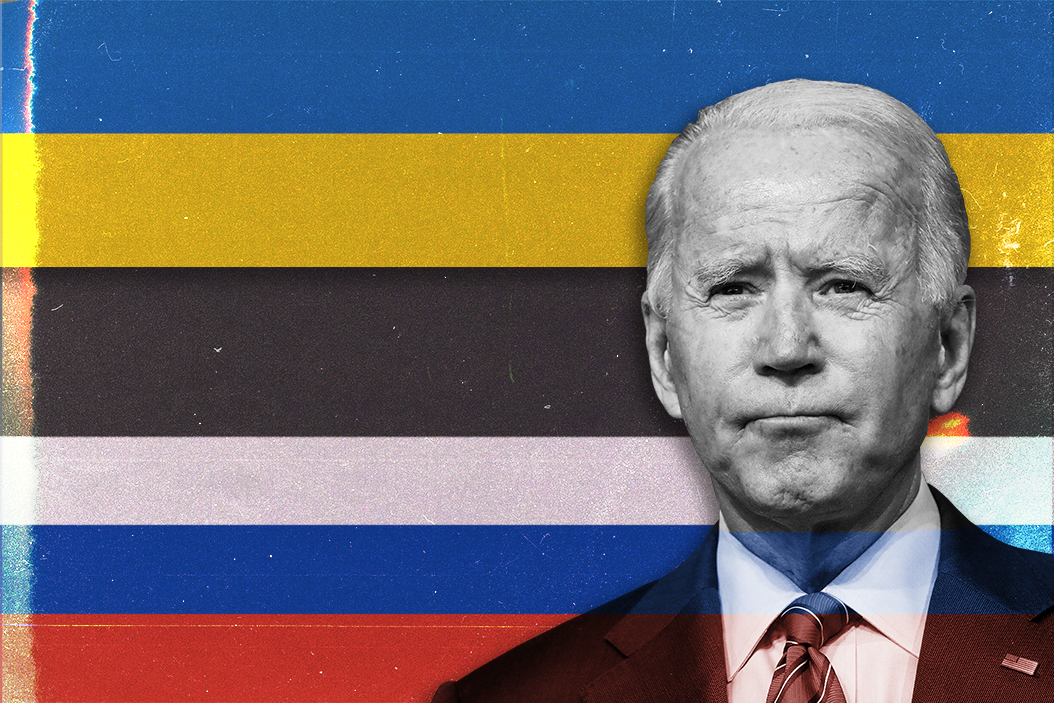

Washington and Brussels align. In a press conference on Tuesday, President Joe Biden announced that the US would slap new sanctions on Russian financial entities, including VEB, a Russian development bank, as well as Russia’s military bank, PSB. Some analysts say this means sanctions against other mainstream banks are being reserved in case of a more overt invasion.

Eurasia Group analyst Zach Witlin says that "everything about [Tuesday's] round of sanctions implied that this is just the tip of the iceberg — if Russia launches a new military operation it won’t just be the state development bank and a defense finance bank that are blacklisted." He also pointed out that this is the third round of sanctions targeting Russian sovereign debt, "all of which have been more severe than the last." The latest order means the Kremlin can no longer access US financing or trade its debt on Western markets.

This aligns with a sanctions package imposed by the European Union earlier on Tuesday that blocks Moscow from accessing the EU's financial markets and bans European investors from trading in Russian state bonds. Indeed, in a sign of the cohesion that Biden has long been pushing for, Brussels and Washington both moved to freeze the foreign assets of some members of the Russian elite, effectively kicking them out of the Western banking system.

What’s more, the White House also said it will deploy more troops to Eastern Europe to support America’s Baltic allies. This comes after Russia’s upper house of parliament gave Putin the go-ahead to use military force outside the country – a procedural move that deepened fears of a full-scale Russian invasion.

Recent developments have thrown oil markets into a tizzy. Fears of war have sent oil and natural gas prices soaring. Disruptions to the market, which saw oil trading at nearly $100 a barrel — heights not seen since 2014 — were further compounded by the new Western punitive measures. Some analysts warn that Putin could subvert energy exports to Europe in retaliation. Taken together, these factors create more uncertainty, which tends to push up prices even more. Still, there’s a lot at stake for Russia too, which depends heavily on revenue from Europe.

President Biden acknowledged that this approach could come with costs for Americans who are already experiencing the burn of inflation. An intensification in Ukraine could further upend energy supplies, but he said this was necessary to respond to “the beginning of a Russian invasion of Ukraine.” He also vowed to do whatever he could to protect the US economy and American consumers.

Is Russia’s economy sanction-proof? As the New Yorker’s Joshua Yaffa told GZERO recently, Putin has been preparing for this standoff with the West for a long time. Indeed, he’s taken painstaking measures to insulate the Russian economy from potential punitive measures, having built up foreign exchange reserves exceeding $600 billion, which comes out to more than 30% of its current GDP, according to the Times).

While Moscow can use those funds to prop up the ruble for some time, being shut out of European and American financial markets long-term would exact a heavy toll on Russia's economy. Is he willing to risk the potential domestic backlash that could come as a result?

Witlin says that while war and a weak ruble are not going to be popular policies among Russians, "Putin is probably counting on either spinning events into a narrative he can sell or otherwise stamping out any backlash." And some public opinion data supports this. The Levada Center recently found that two-thirds of Russians "blamed either the US or Ukraine for the worsening situation in eastern Ukraine," Witlin says. What's more, "about two-thirds of respondents in Russia said they were not worried about sanctions.