May 30, 2024

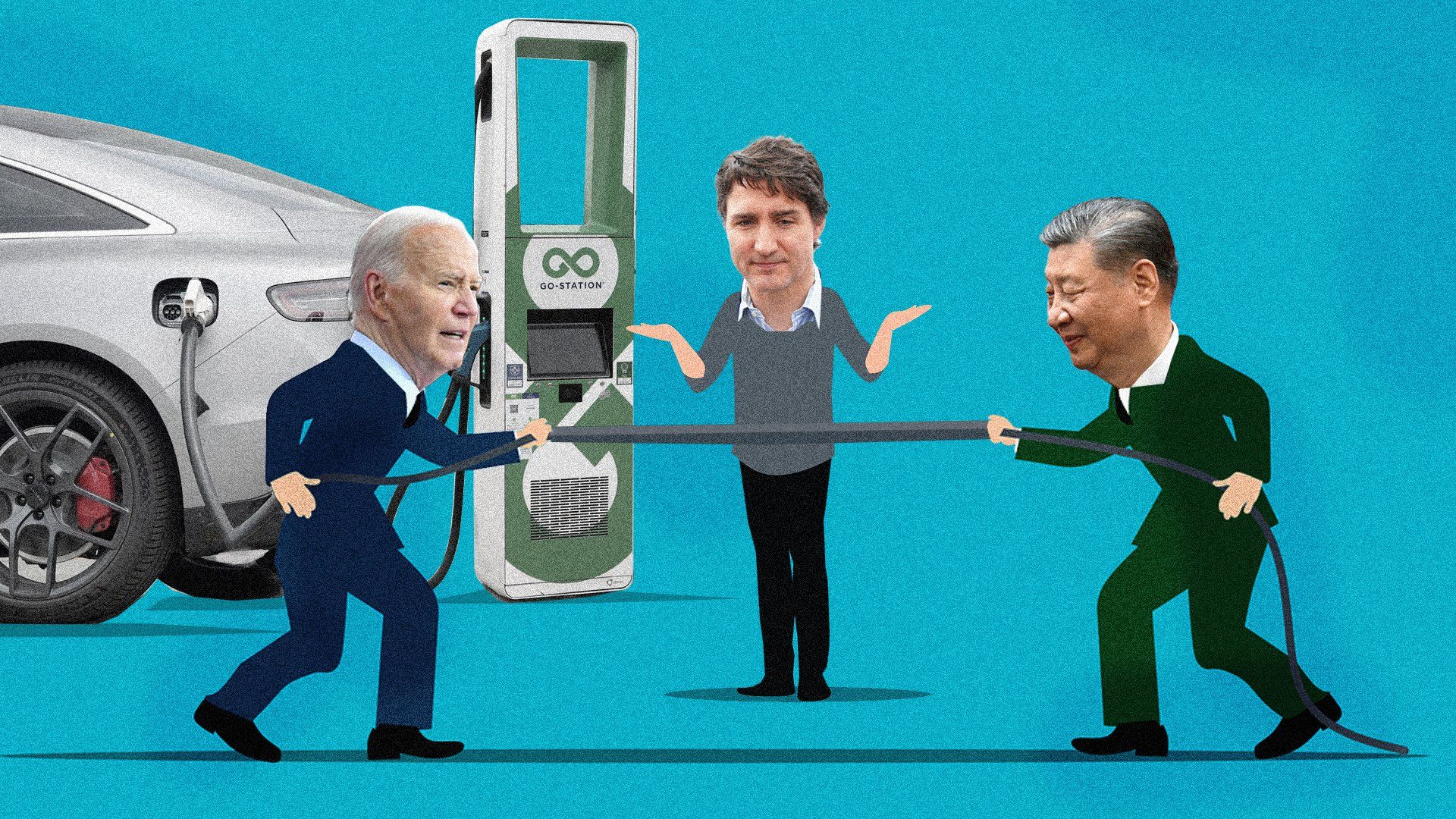

Canada must be tired of getting stuck between major world powers. Yet, as the Biden administration moves to nearly quadruple tariffs – to a whopping 102.5% – on imported Chinese electric vehicles, the Trudeau government may have to choose between provoking a trade war with China or alienating its top ally.

The increased US tariffs on Chinese EVs are part of a package of trade measures the Biden administration is imposing on its rival. They will also hit steel, aluminum, solar cells, semiconductors, batteries, and more as the administration seeks to shield domestic workers from “China’s unfair trade practices concerning technology transfer, intellectual property, and innovation.”

Subsidy Wars

President Joe Biden argues that China has flooded the market with “artificially low-priced exports” subsidized by the state. That’s true. But the US and Canada are playing the subsidy game, too.

In 2022, the White House introduced a $7,500 consumer tax credit for eligible, made-in-America EVs. The Inflation Reduction Act also committed money for EV charging infrastructure and EV battery manufacturing. In March, China opened a World Trade Organization case against the US, the Inflation Reduction Act, and its “discriminatory subsidies.”

For its part, Canada has a 6% tariff on Chinese EVs and offers a $5,000 rebate for zero-emissions vehicles. Along with provincial assistance from Ontario, the federal government has recently spent just under CA$30 billion on deals for battery plants with Stellantis and Volkswagen and another CA$5 billion for four Honda EV plants in Ontario as it looks to build a domestic industry and supply chain.

The battle with China over EVs is layered, with Biden and Justin Trudeau expressing concerns over jobs, economic growth, supply-chain integrity, and national security, while surely thinking about their political futures ahead of upcoming elections.

Currently, Chinese EVs comprise 60% of global sales, but a fraction of zero-emission vehicle sales in the US and Canada, and none of those are made by Chinese manufacturers. But other manufacturers are building their EVs in China and selling them in the US, including Volvo’s EX30.

In 2023, Tesla – which sells roughly a third of all EVs in Canada – began manufacturing its Canadian EVs in China, raising the value of the Chinese import market from CA$84 million to CA$2.2 billion. Now China is looking to expand its EV presence in both countries, including for its own vehicle brands.

The EV Transition Is Coming – and it’s Political

EV sales have recently dipped in the US and Canada, but the Biden administration is still aiming for half of all new vehicles sold to be electric by 2030, while Canada is mandating that all new passenger vehicle sales must be electric by 2035. The market for these cars and trucks will surely keep growing as prices come down, manufacturers open shops, and charging infrastructure expands.

Both leaders are worried that China will be the principal beneficiary of the EV transition at the expense of domestic industries and workers. EV politics may thus be unavoidable for good reason. In Canada, the auto manufacturing industry employs 135,000 workers directly and another 500,000 indirectly – most of whom are employed in Ontario, the country’s most populous, and electorally stacked, province. It also accounts for CA$16 billion in GDP.

In the US, the numbers, and stakes, are even higher. Over 4.4 million Americans work in auto manufacturing or retail, with nearly another 6 million indirectly employed by the industry while accounting for about 3% of GDP.

Graeme Thompson, a senior analyst with Eurasia Group's global macro-geopolitics practice, says the political calculus for the Biden administration is clear on this matter and points out that the tariffs – not just on EVs, but on steel, aluminum, and more – are at least in part about domestic political concerns.

“It’s classic US protectionism vis-a-vis domestic manufacturing,” he says, adding that it is no coincidence we’re seeing this in an election year.

“It looks increasingly like Joe Biden's path to the presidency runs through Wisconsin, Michigan, and Pennsylvania,” he says, where manufacturing is king. And Biden might not be alone in thinking through the politics of this conundrum.

Speaking to reporters after a visit to the Service Employees International Union International Convention in Philadelphia, Trudeau said he was “watching very closely what the Americans are doing” with tariffs on China.

Canada is now “considering all measures,” including a tariff bump of its own as it seeks to further harmonize its trade policy and EV industry with the US while protecting its domestic auto industry and workers. The government isn’t committing to anything, but the pressure to act is building.

Not Necessarily Tariffs, but Tariffs if Necessary

The Canadian automotive industry is calling for the federal government to be prepared to match Biden’s tariffs.

Brian Kingston, president of the Canadian Vehicle Manufacturers’ Association, says Canada should be ready in case subsidized Chinese EVs hit the market en masse.

“We don't have to immediately respond and increase tariffs today, but we know what can happen. So let's make sure that our defenses are adequately prepared in the event that this occurs,” he says.

Taking this posture would protect the Canadian industry from the consequences of falling out of step with the US, he argues.

“The Canadian automotive industry is and always has been completely integrated with the United States,” he notes. “The reason companies invest and build in Canada is because we align our regulations … with the Americans … But that success depends on maintaining our alignment and maintaining our preferential access to the US market through the USMCA.”

He also argues Canada should scrap its EV 2035 mandate.

Kingston says that plan “has no regard for where those EVs are manufactured and whether or not the supply chain in North America is developed fully enough to meet the targets that have been established,” adding that the US isn’t mandating hard targets, having instead “connected their environmental policy with their industrial policy.”

Caught in the Middle

China is Canada’s second-largest trade partner after the US, but that fact is misleading. In 2023, 78% of Canadian exports went stateside while about half of its imports came from the US, with total goods worth over $770 billion compared to about $64 billion with China. While a trade war with China could be costly for Canada and its exports, it would pale in comparison to whatever the US might do if its ally stepped too far out of line – especially if Donald Trump wins in November.

Thompson says Canada might expect to see consequences if Chinese EVs flood the market.

“There would be some pressure from the US if Chinese EVs start washing up on Canadian shores,” he says. That might invite US retaliation.

“You could imagine that might come up in the context of a USMCA review or renegotiation,” he adds.

Despite Canada’s dilemma, it may have few options but to follow the US lead.

“Canada is kind of in between these two giants,” Thompson says, “but at the end of the day, it has so many more interests on the US side, whether economic and trade or defense and national security, that there's not really much of a choice to make.”

More For You

Xi Jinping has spent three years gutting his own military leadership. Five of the seven members of the Central Military Commission – China's supreme military authority – have been purged since 2023, all of whom were handpicked by Xi himself back in 2022.

Most Popular

Sponsored posts

Five forces that shaped 2025

What's Good Wednesdays

What’s Good Wednesdays™, January 28, 2026

Walmart sponsored posts

Walmart’s commitment to US-made products

- YouTube

In this episode of GZERO Europe, Carl Bildt examines how an eventful week in Davos further strained transatlantic relations and reignited tensions over Greenland.

- YouTube

In this episode of "ask ian," Ian Bremmer breaks down the growing rift between the US and Canada, calling it “permanent damage” to one of the world’s closest alliances.

An employee works on the beverage production line to meet the Spring Festival market demand at Leyuan Health Technology (Huzhou) Co., Ltd. on January 27, 2026 in Huzhou, Zhejiang Province of China.

Photo by Wang Shucheng/VCG

For China, hitting its annual growth target is as much a political victory as an economic one. It is proof that Beijing can weather slowing global demand, a slumping housing sector, and mounting pressure from Washington.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.