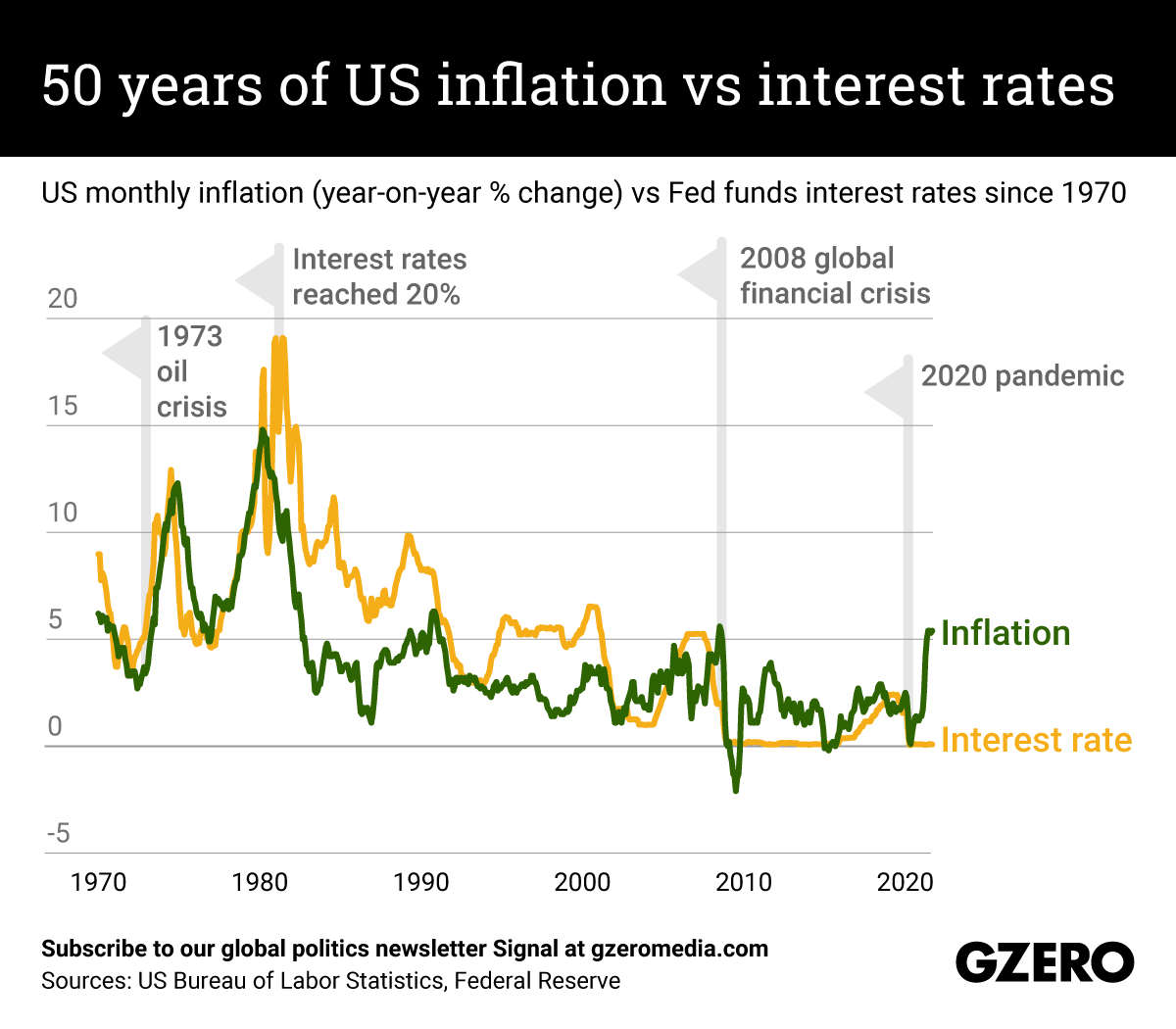

The Graphic Truth: 50 years of US inflation vs interest rates

Inflation in the US remains at its highest monthly level since the 2008 financial crisis. Right now most economists agree that rising prices are being driven by pandemic-related supply chain disruptions, which the government can do little about. This has given some oxygen to supporters of the Biden administration's big-spending agenda, who now insist that inflation will ease up once supply chain disruptions resolve. Deficit hawks, for their part, still say that the Federal Reserve is overheating the US economy by keeping interest rates low because it hopes inflation will be short-lived. We compare US inflation and interest rates over the past half century, a period in which America has suffered double-digit inflation figures more than once.

- Think buying American will help ease inflation? Larry Summers says it won’t - GZERO Media ›

- Inflation nation: What’s driving US prices higher? - GZERO Media ›

- Larry Summers: Rising inflation makes society feel "out of control” - GZERO Media ›

- Biden could get Saudis to push Russia out of OPEC+ - GZERO Media ›

- Are we in a recession? - GZERO Media ›

- How bad is inflation in the US and around the world? - GZERO Media ›

- Podcast: Making sense of global inflation, looming recession, & economists who disagree - GZERO Media ›

- S3 Episode 3: Will there be a recession? - GZERO Media ›