October 06, 2022

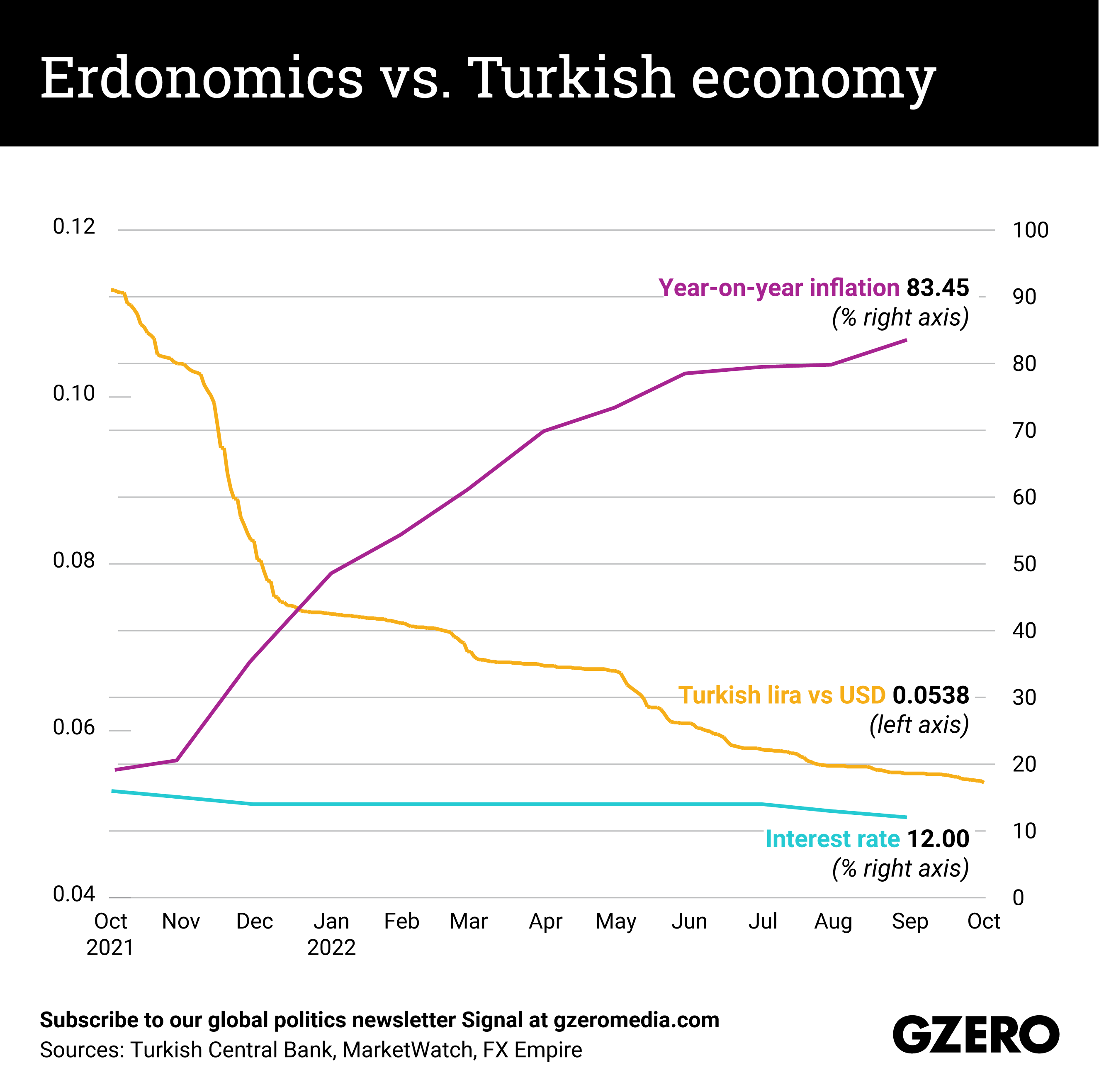

This week, Turkey’s annual inflation rate reached 83.45%, a 24-year high. And that's just the official number — independent experts believe the actual figure is more than 186%, which means prices have almost tripled.

Yet President Recep Tayyip Erdoğan doesn't seem to be bothered by sky-high inflation, insisting he has the magic formula for Turkey's economy to grow out of the problem: continue to defy economic orthodoxy by keeping interest rates low. Now they’re at 12%, but if you factor in inflation, the real rate is minus 68%, which means that cash is burning a hole in the wallets of Turkish banks.

Erdonomics is all about putting growth above stability. If Turkey makes it easier to borrow money to invest, do business, and create jobs, GDP will expand at a faster rate than prices are rising.

To be fair, Turkey's economy is indeed growing, to the tune of a robust 7.6% year-on-year in the second quarter of 2022. That’s 0.3 percentage points more than in the first three months of the year.

Is it growing enough? Nope, according to pretty much any economist not on the president's payroll. Erdoğan’s ultra-loose monetary policy, experts argue, is killing the economy.

Another big problem is that Erdonomics has made the local currency nosedive against the US dollar. The greenback is very strong this year, true, but Turks and foreign investors would rather save or spend dollars on imports and stock up on worthless liras. Turkey also has $182 billion worth of debt it needs to pay back by April 2023, putting even more pressure on the lira.

Still, Erdoğan won't let Erdonomics go because he has an election coming up. When Turks go to the polls next year, the president hopes that if the economy keeps growing and inflation somewhat tapers off, re-election is all but assured. But that's a big if — and a major gamble for Turkey's strongman leader.

(Also, here's a fun take on Erdonomics by ... Erdoğan himself.)This article comes to you from the Signal newsletter team of GZERO Media. Sign up today.

More For You

The Supreme Court curbs Trump’s trade agenda, but the administration is undeterred. So, what's next? Ian Bremmer sits down with economists Scott Lincicome of the Cato Institute and Paul Krugman to examine the future of tariffs, and the politics shaping trade policy.

Most Popular

Think you know what's going on around the world? Here's your chance to prove it.

New fronts of Iran conflict, A better week for Russia than Ukraine, US and Spain butt heads

Mar 05, 2026

An explosion in Sanandaj, Kurdistan province, Iran, amid the U.S.-Israeli conflict with Iran, in this still image from a social media video released on March 5, 2026.

Social Media/via REUTERS

Two Iranian drones hit Azerbaijan, Iran’s northern neighbor, on Thursday, injuring four people and expanding the Iran conflict onto another front.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.