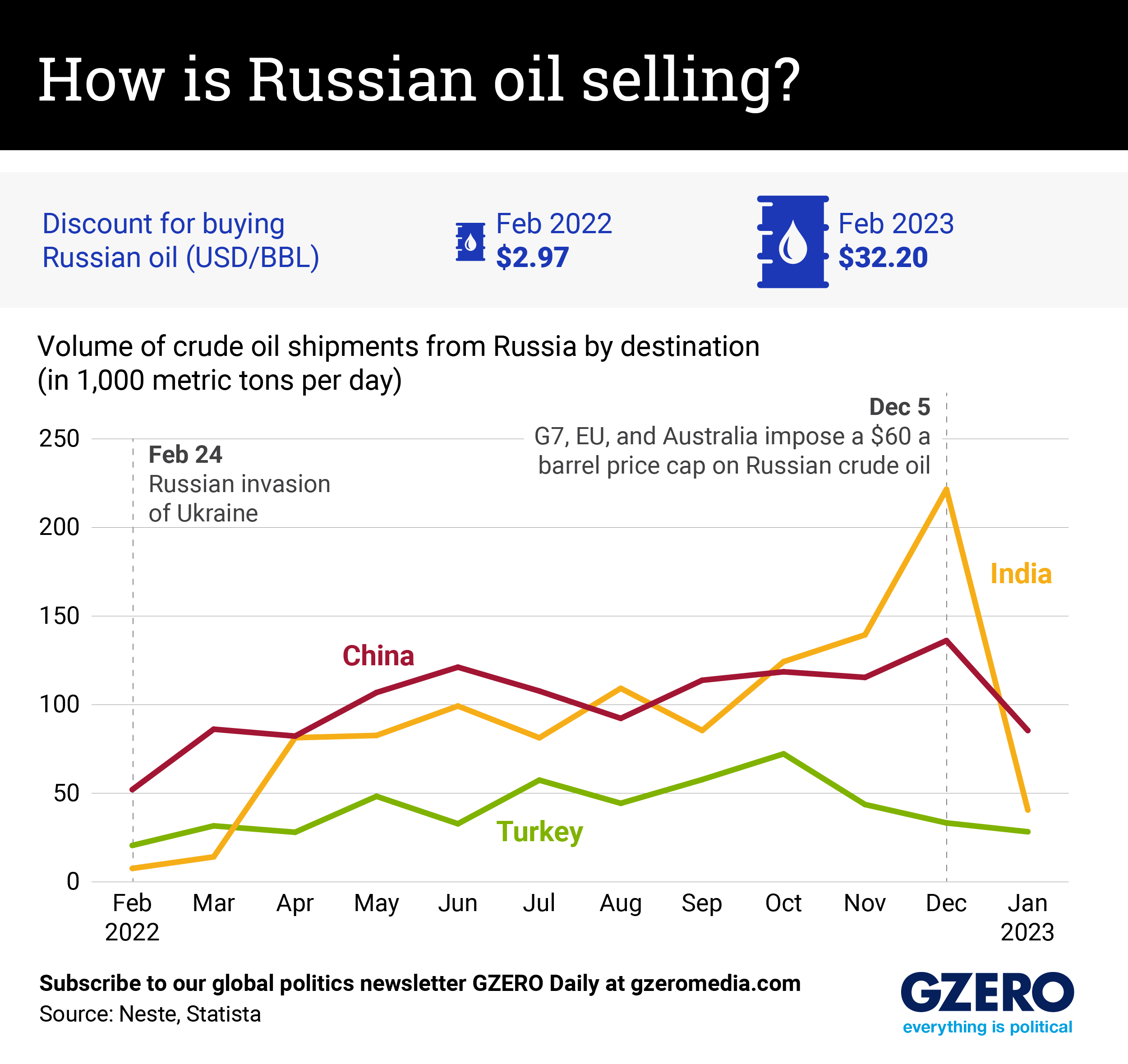

Russian oil has been selling at a massive discount since the war in Ukraine began last February, which has been a double-edged sword for the Kremlin. On the one hand, it brings in some much-needed revenue and makes Russian crude an attractive buy at a time of global inflation. On the other hand, selling at a discount means selling at a loss in revenue to a dwindling number of buyers. Adding to Russia’s woes, on Dec. 5, the EU instituted an embargo on Russian crude shipments at sea, leading to a massive drop-off in exports across the board, even to markets it depends on in Asia — chiefly China, India, and Turkey. The G7, Eu, and Australia also placed a $60 per barrel cap on Russian oil, so the discount is likely to remain in place as Russia tries to ship over long distances to Asia. We look at the discount for Russian crude today vs. when Russia invaded Ukraine, and how much each of Russia’s top three customers has been buying since the war began.

More from GZERO Media

Listen: On the GZERO World Podcast, Ian Bremmer sits down with Venezuela’s most prominent opposition leader, María Corina Machado, who remains in hiding. They discussed the future of her country, the role of the United States, and why she believes Nicolás Maduro’s grip on power is weaker than it seems.

Venezuelan opposition leader María Corina Machado threatens the country's dictatorial regime like no opposition leader before her, and that's why she's in hiding. How does she keep the pressure on Nicolás Maduro's administration from her hideout? Ian Bremmer explains.

South Korea’s Constitutional Court on Friday voted unanimously to oust impeached President Yoon Suk-yeol over his decision to declare martial law in December. Supporters of Yoon who gathered near the presidential residence in Seoul reportedly cried out in disappointment as the court’s 8-0 decision was announced. Others cheered the ruling. The center-right leader is now the second South Korean president to be ousted.

Stocks have plummeted, layoffs have begun, and confusion has metastasized about the bizarre method the United States used to calculate its tariff formula. But Donald Trump says it’s “going very well."

The second largest party in South Africa’s coalition, the business-friendly Democratic Alliance, launched a legal challenge on Thursday to block a 0.5% VAT increase in the country’s new budget, raising concerns that the fragile government could collapse.

As we wrote in February, Turkey’s president, Recep Tayyip Erdogan, has big plans for Syria. Erdogan’s government was a crucial backer of the HTS militia, an Islamist rebel group that ousted longtime Syrian strongman Bashar Assad in December, and it now wants Turkey’s military to take over some air bases on Syrian territory in exchange for Turkish training of Syria’s new army.

Remember the TikTok ban? The new deadline President Donald Trump set for the app to find an American buyer or be banned from US app stores, midnight Saturday, is rapidly approaching.

Overnight, the US moved to having the world’s highest tariffs by a long margin. Here is Ian Bremmer's Quick Take on the near and long-term fallout

Have you stayed atop GZERO’s news coverage this week? Here's your chance to prove it.