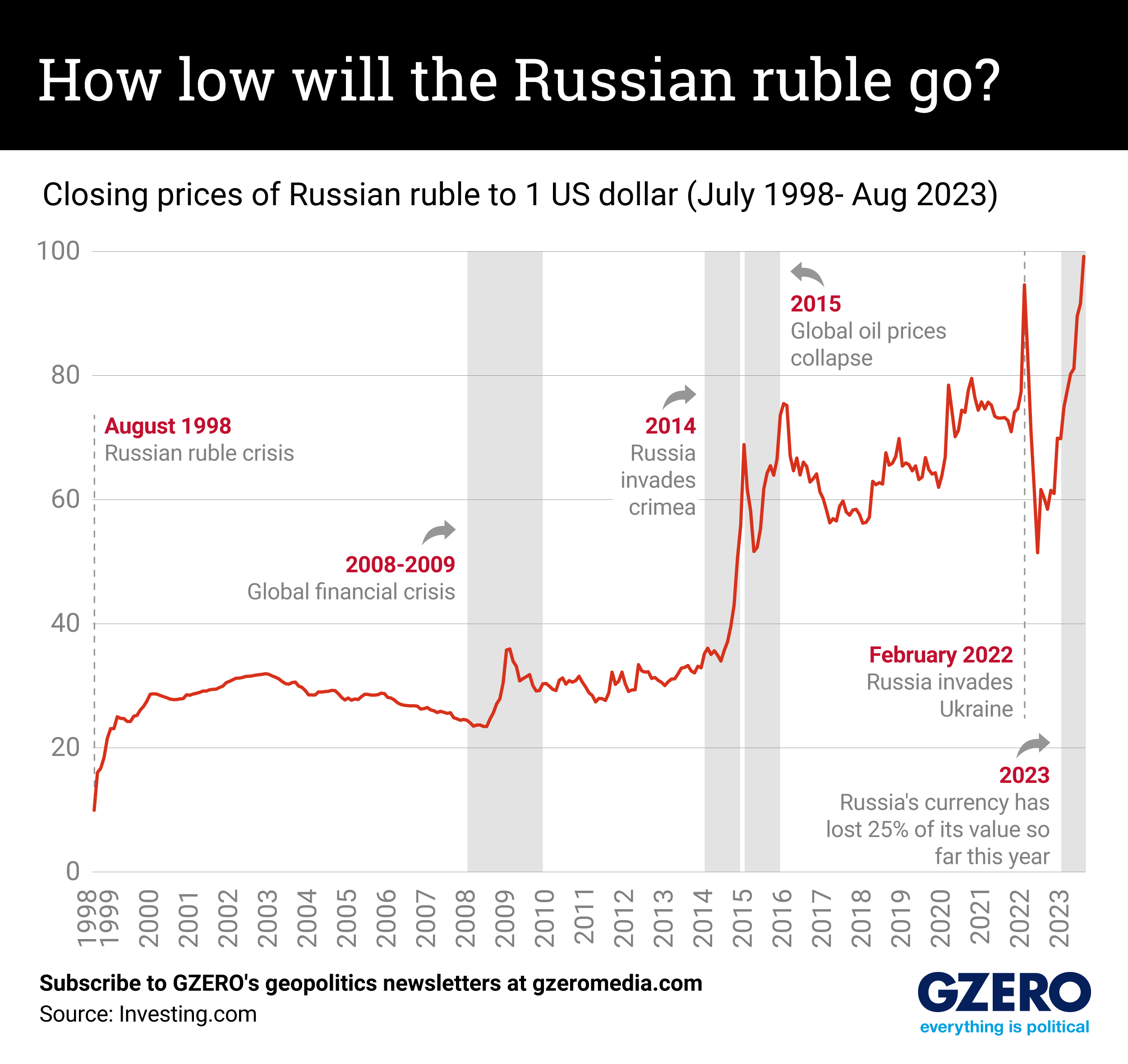

The Graphic Truth: How low will the Russian ruble go?

In an emergency meeting on Tuesday, Russia’s central bank raised interest rates to 12% (up from 8.5%) after its currency reached an almost 17-month low against the US dollar. Clearly the Kremlin is spooked that the Russian ruble has lost 25% of its worth against the greenback over the past seven months alone.

The ruble – which this week slid past 101 against the US dollar, before recovering slightly to 98 on Tuesday – has ebbed and flowed since Russian forces invaded Ukraine in Feb. 2022. For context, when oil prices were soaring last July (bolstered by the Kremlin's capital controls), the ruble touched around 61 to the dollar. But many analysts are skeptical that this move will be able to stabilize the ruble, warning that Western sanctions will make it very difficult for Moscow to attract foreign investment.

Still, last summer, things looked pretty rosy for the Russian economy due to high oil and gas prices which, many suggested, were scarcely being impacted by harsh Western sanctions.

At the time, Russia’s trade surplus was further bolstered by the fact that imports fell as Russians’ spending habits were crimped by the uncertainty of war.

But the current currency turndown shows that when compounded by a range of other fiscal and economic factors, Western sanctions are in fact having a strong impact on Moscow’s trade balance – and the value of its currency.

The decline is significant enough that the Bank of Russia last week announced that it would stop buying foreign currency for the remainder of the year in a bid to avoid further volatility.

So what are the key factors at play?

Energy revenue is down. Western sanctions, augmented by a cap on oil prices introduced by G7 countries in recent months, are hurting the Kremlin’s bottom line. Cash inflows from oil and gas, Russia’s main exports, have fallen by 47% in the first six months of this year compared to the same period in 2022. Although countries like China and India continue to buy large amounts of Russian oil and gas, much of this has been gobbled up at a steep discount.

At the same time, imports have recovered in part because the state itself relies on things from abroad to keep its war machine pumping. And its military spending is only growing. Consider that Russia has doubled its 2023 defense spending target from the previous year to more than $100 billion a year.

Capital flight. Making matters worse, this dynamic has been exacerbated by the fact that many Russians have been pulling their assets from the Russian banking system amid fears about regime instability. According to the central bank, Russians withdrew a whopping 100 billion rubles (around $1 billion) from the banking system over just a few days amid Wagner chief Yevgeny Prigozhin’s short-lived mutiny back in June.

Recent events have led to increased calls to make borrowing costs higher, culminating in today's emergency measures. Indeed, Putin’s top economic advisor said earlier this week that loose monetary policy is to blame for the ruble’s downward spiral. Though the bank raised interest rates to 8.5% last month, it was the first steep hike in more than a year.

Looking ahead. While a weak ruble could actually help the Kremlin fund its war effort – more foreign currency would translate into more rubles to buy stuff – brewing chatter about current parallels to Russia’s last deep financial crisis, 25 years ago on Aug. 17, do not look good for a regime trying to project competence and strength. So how do current trends compare to Russia’s last financial catastrophe of 1998? We take a look at the ruble’s value against the US dollar since then.