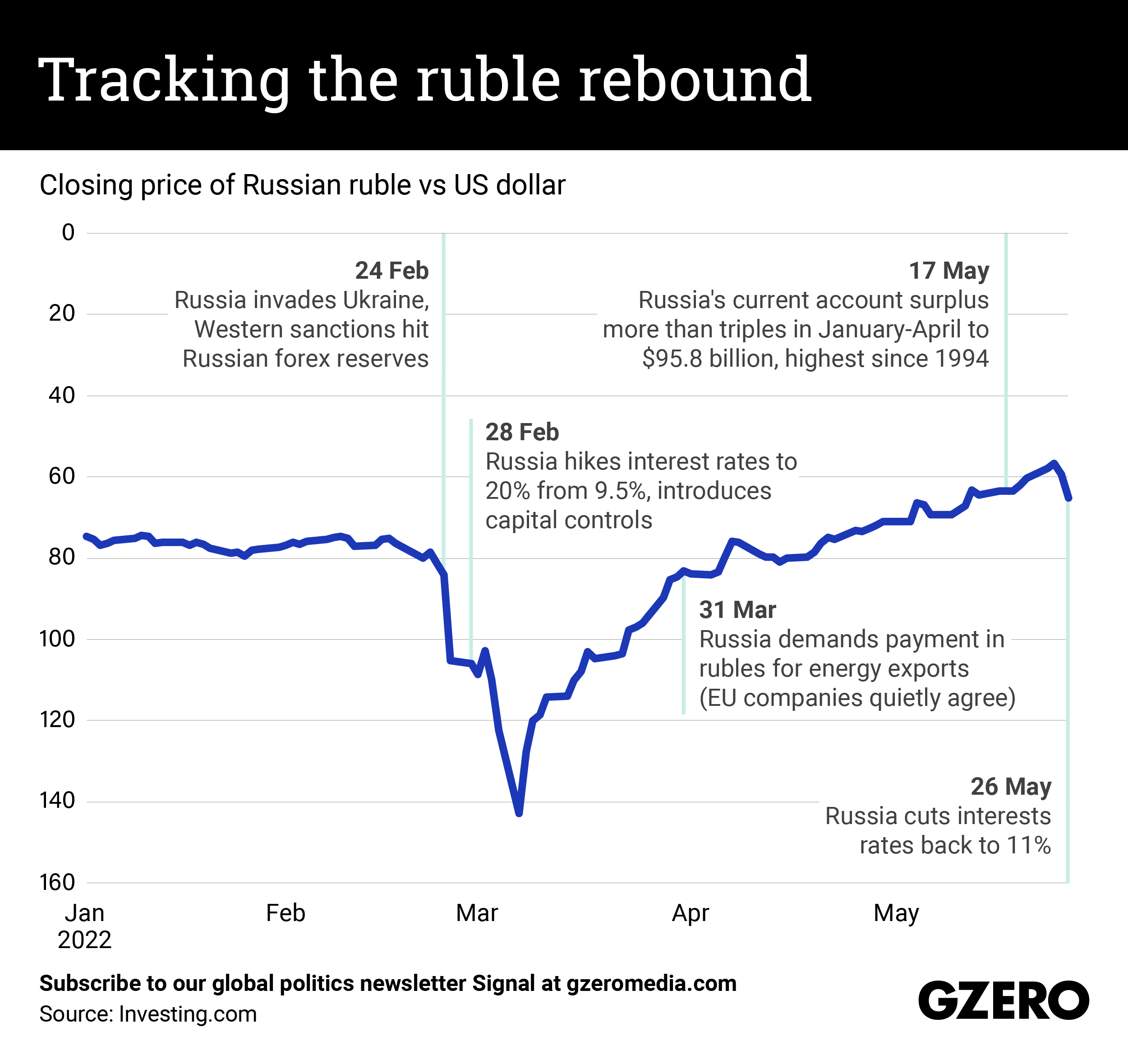

The Graphic Truth: Tracking the ruble rebound

The ruble is back on top. Why?

What a wild ride the ruble has had so far this year.

Russia's currency nosedived in late February, losing as much as 30% of its value against the US dollar when Western nations slapped tough sanctions on the Kremlin for invading Ukraine. But then Vladimir Putin pulled out all the stops to save the ruble.

Spoiler: it worked.

First, the central bank immediately doubled interest rates and imposed strict capital controls to stop cash from leaving the country. The Kremlin also forced corporations to exchange most of their foreign currency receipts for rubles, creating artificial demand for the Russian currency.

Next, Putin demanded that all “unfriendly” countries — those that imposed sanctions on Russia — pay for Russian oil and natural gas in rubles. Although most European governments refused, many private companies in the EU decided to comply rather than risk disruptions to their energy supplies.

What’s more, imports have plummeted due to sanctions, meaning that fewer rubles are chasing foreign goods, which props up the value of each ruble. And energy prices are at multiyear highs. In the first four months of the year, Russia had its highest current account surplus — the difference between exports and imports — since 1994.

As a result, the ruble is now up 25% against the dollar this year, making it the world’s best-performing major currency in 2022.

So, is this good or bad for Russia? It depends. On the one hand, a strong ruble is surely a source of national pride for many Russians. On the other, it's hardly convenient if sanctions make it hard to buy foreign goods with it.

Also, a strong local currency could hurt the budget: since expenditures are in rubles, a weak ruble is actually the best way to top up the state's coffers when energy prices are high because sales in dollars or euros get converted into more rubles.

This comes to you from the Signal newsletter team of GZERO Media. Subscribe for your free daily Signal today.