April 07, 2021

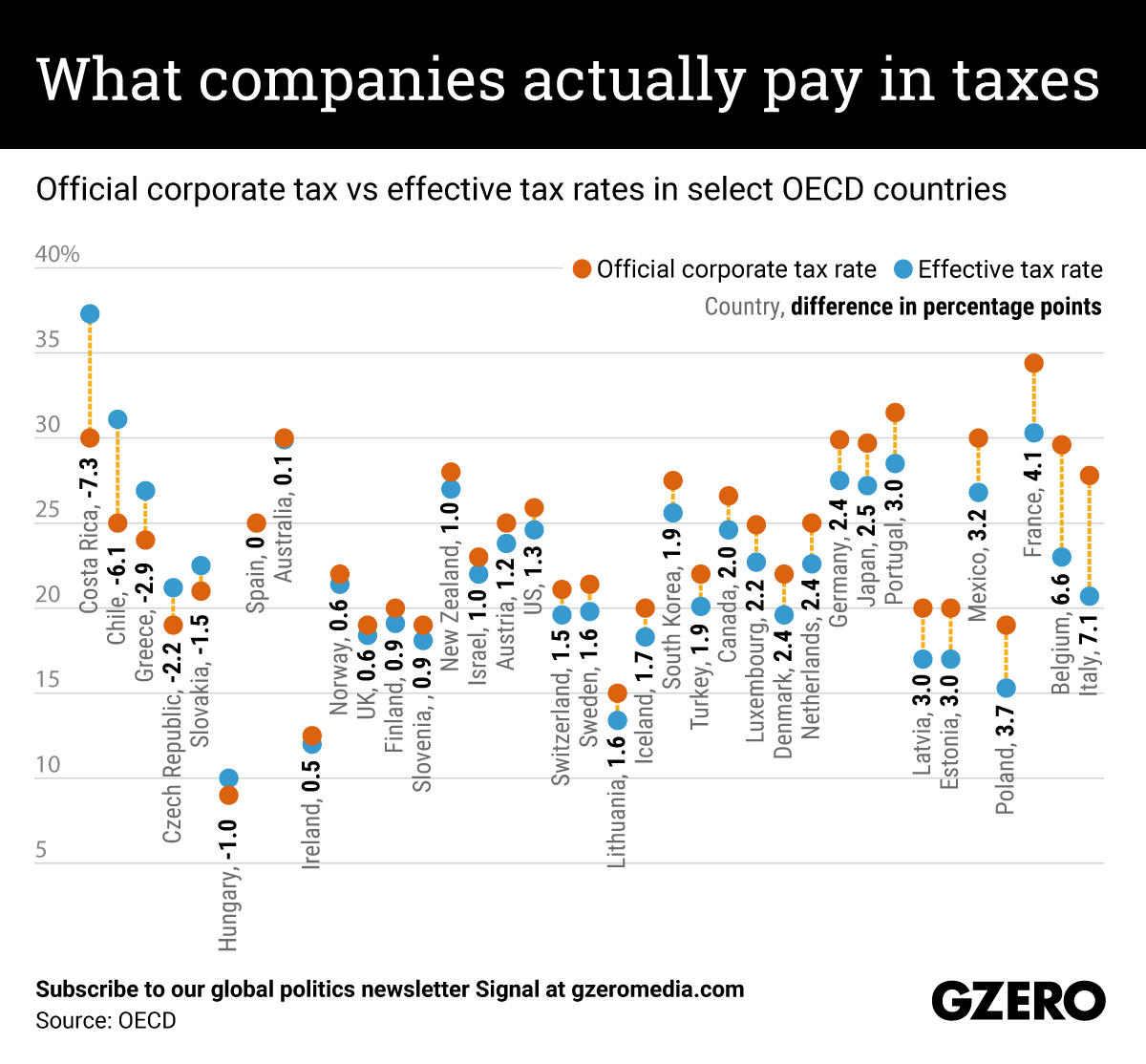

On top of the global debate about enacting a minimum global tax for multinational corporations, there's another growing movement in a host of countries for all firms to pay their fair share in taxes, whether they do business abroad or not. Many US corporations are notorious for getting away with paying little to no federal taxes by taking advantage of multiple loopholes in the tax code — which is true for a lot of them. However, as a whole the average percentage of income US corporations do pay taxes on — their effective tax rate — is in reality not much lower than the legal national rate due to additional taxes levied by some US states and cities — the same as in many other developed economies. We compare the official and the effective corporate tax rates in some nations around the world.

More For You

- YouTube

Putin can't stop won't stop. #PUPPETREGIME

Most Popular

We’re moving toward a world where roads don’t just move traffic — they enable services and transactions. Mastercard is working with Volvo and the North Carolina Turnpike Authority on a pilot that explores in-vehicle toll payments without transponders, signaling how V2X connectivity can make infrastructure a platform for data and payments. This future of connected transportation aims to make travel safer, smoother and smarter. Read the full article here.

Bad Bunny during the Super Bowl LX halftime show press conference at Moscone Center.

Kirby Lee-Imagn Images

100 million: The number of people expected to watch the Super Bowl halftime performance with Bad Bunny, the Puerto Rican superstar and newly minted Album of the Year winner at the Grammys.

Alysa Liu of Team USA during Women Single Skating Short Program team event at the Winter Olympic Games in Milano Cortina, Italy, on February 6, 2026.

Raniero Corbelletti/AFLO

Brazilian skiers, American ICE agents, Israeli bobsledders – this is just a smattering of the fascinating characters that will be present at this year’s Winter Olympics. Yet the focus will be a different country, one that isn’t formally competing: Russia.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.