What We’re Watching: Three ways to address inflation … with varying degrees of success

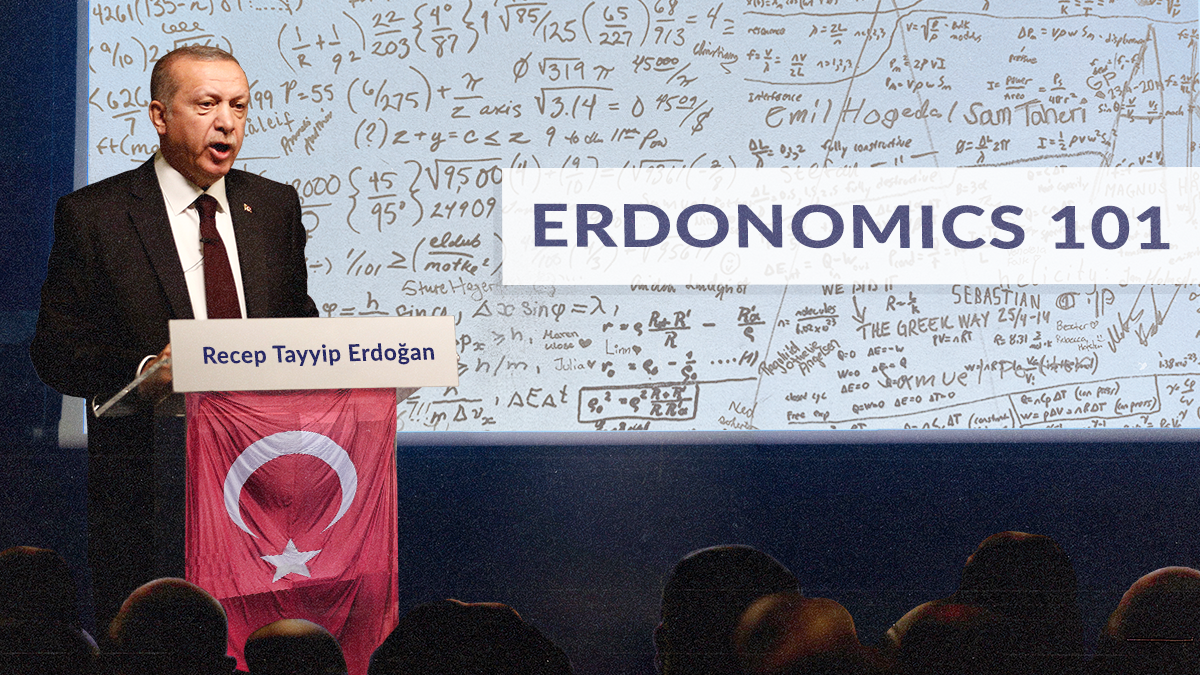

Erdonomics: Growth > stability

Turkey has long had a hyperinflation problem, but that doesn’t mean that its central bank has sought to raise interest rates to bring prices down. In fact, Turkey’s President Recep Tayyip Erdogan, whose unorthodox economic approach has been dubbed Erdonomics, has even sought to lower interest rates during inflationary times. Why?

Central to his approach is the belief that economic growth trumps all, including price stability. So Turkey’s central bank has been unwilling to raise interest rates to reverse hyperinflation, and Erdogan has even called himself an “enemy” of interest rates.

As the Turkish president explains it, keeping interest rates low – and static – stimulates demand, driving economic growth.

But that hasn’t panned out. Inflation in Turkey soared to a quarter-century high of 85% in October – largely due to roaring food and fuel prices. Crucially, analysts think the official number was closer to 186%, meaning prices would have almost tripled. As a result, the average Turk has far less disposable cash to inject into the economy. What’s more, Turkey has seen its currency, the lira, plummet a whopping 90% since 2008.

What do Turks think of the cost-of-living crunch? They will get to weigh in on May 14, when the country heads to the polls. Erdogan is facing a united opposition that has been pushing the message that he has wrecked the economy.

Price controls and unintended consequences

Inflation = prices going up. But what if they just … didn’t?

That’s basically the thought process behind price controls, an alternative tactic for fighting inflation where the government mandates maximum prices for goods. While this might sound good, price controls remove the magical balance of supply and demand: When something is expensive, it signals to producers that they can profit by increasing supply. But if the government artificially holds down prices, producers aren’t incentivized to meet demand, which leads to supply shortages, inefficiencies, and unintended consequences.

Most economists believe that monetary policies can tame inflation without capping prices. But with inflation now running rampant, some left-wing policymakers and economists are revisiting the idea. In 2022, US Sen. Elizabeth Warren proposed a bill to outlaw “abusive price gauging” during market shocks. Progressives argue that price caps help the poor, but there’s a catch.

The thing about price controls is that they tend to work in the beginning. In 1971, President Richard Nixon tried to nip inflation in the bud by implementing a 90-day freeze on most wages, prices, and rents. The result: Inflation fell by 50% ... at first. But as soon as the government eased restrictions, prices shot back up, requiring another round of caps that barely made a dent. The takeaway: Price controls might help in the short run, but not in the long run.

Argentina has long been addicted to using price controls for political gain. In late 2021, after an electoral loss attributed to 53% inflation, the ruling party slapped price controls on over 1,400 products. But like the last time the government did this in 2013, it’s only making inflation worse — currently over 100% year-on-year.

The historical upshot of price controls: When the precise balance of supply and demand is replaced by the blunt axe of government policy, the solution is more likely than not to be worse than the problem.

The Goldilocks approach to adjusting interest rates

Western central banks are, broadly speaking, focused on two key things: Keeping inflation down and employment up. To strike the right balance, and, like Goldilocks, ensure that the economy is neither too hot nor too cold, many central banks adjust interest rates to prevent the economy from overheating.

Given the inflationary pressures of the past year – as a result of the war in Ukraine, supply chain kinks, and pandemic stimulus – the US Federal Reserve, European Central Bank, Bank of England, Bank of Canada, and others, have aggressively raised interest rates to increase the cost of credit within their respective economies.

While interest-rate policy aims to keep consumer prices steady (global food prices, in particular, have soared), central banks’ policies also influence – and are influenced by – financial behaviors.

For example, market turmoil in the US in recent times has tampered with investors’ appetite for risk. This has partly contributed to mass layoffs in the tech sector, something the Fed is watching closely as it adapts its interest-rate policy.

But not all wealthy countries are adopting this approach. For instance, the Bank of Japan, which has long focused on keeping interest rates low to stimulate growth, has left interest rates at - 0.1%, leading to stubbornly high prices for consumers.

__________________________________

Not everyone hates inflation – just ask the dinosaur skeletons

Rising prices are a headache for most people, but not everyone is unhappy. People who have low fixed-rate mortgages or other fixed-cost debts, for example, actually get a break from inflation, because it has the effect of reducing the burden of repaying or servicing what they’ve borrowed. Paying what they owe costs less because the currency has lost value compared to when they took out the mortgage.

Meanwhile, there are folks who hold assets that tend to rise in value when inflation goes up, such as stocks in energy or food production companies. Another is gold, which generally rises in value during bouts of inflation because it’s seen as a more stable store of value — after all, it’s been used as money for 2,500 years.

But the most colorful beneficiaries of inflation may be hoarders or other collectors of items like Rolex watches, fine art, classic cars, designer handbags, sports memorabilia, fine wines, and even dinosaur skeletons!

As inflation drives down the value of money, people invest in items like these, which are seen to hold value more predictably than cash. Not everyone has access to a fine wine cellar or a classic car garage, but surely you’ve got an unexpected inflation hedge lurking in some old shoebox somewhere, don’t you?

Tell us what you collect/hoard for rainy days here.