US Politics In 60 Seconds

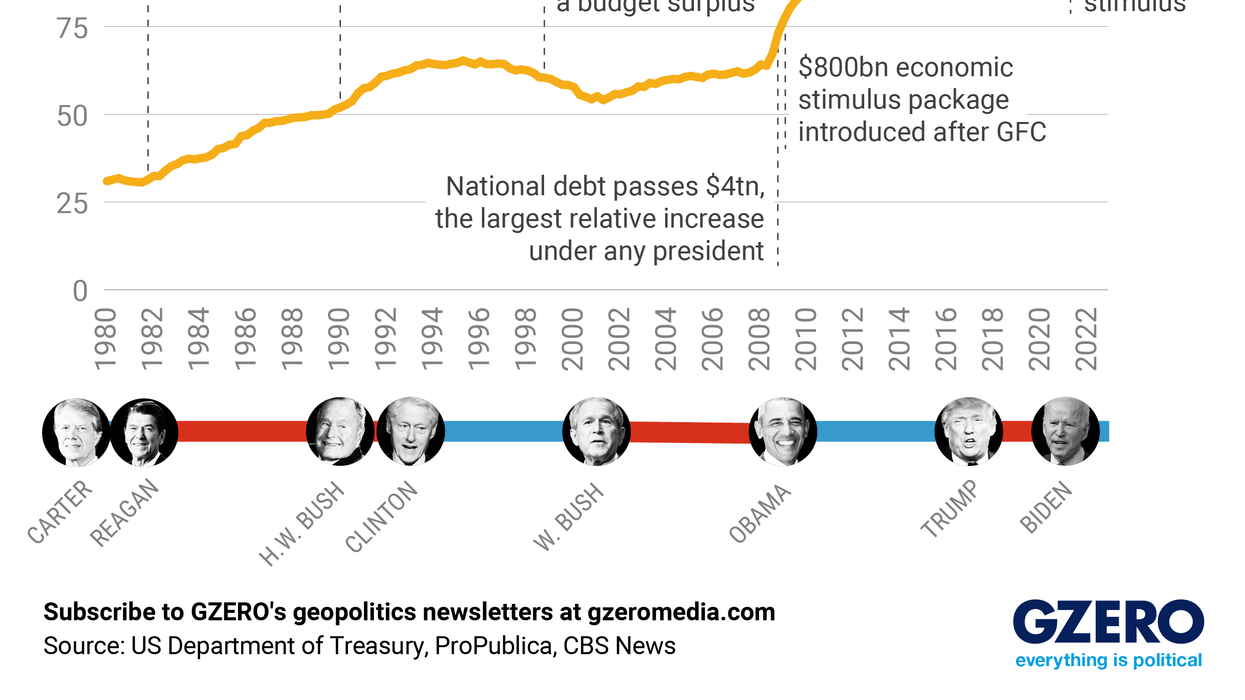

Biden & McCarthy both win in debt ceiling showdown

Who won the debt ceiling showdown between President Biden and House Speaker Kevin McCarthy? Jon Lieber, head of Eurasia Group's coverage of political and policy developments in Washington, DC shares his perspective on US politics.

Jun 02, 2023